ZipSpaces: A Bold Idea to Reactivate Vacant Storefronts. ZipSpaces: A Bold Idea to Reactivate Vacant Storefronts Car sharing, bike sharing, and now…storefront sharing?

That’s the bold idea behind “ZipSpaces” – an effort to bring vacant storefronts back to life by renting them out on a timeshare basis. Rebekah Emanuel is the mastermind behind this idea. As the name would indicate, she modeled the program after the well-known Zipcar program. ZipSpaces allows you to “check out” commercial space that would otherwise sit vacant. Similar to the online vacation rental site AirBnB, owners post their space and indicate what the space can be used for: does it include a kitchen, could it be used for a restaurant? Renters view the spaces online and rent properties accordingly. ZipSpaces has integrated mobile technology to allow users to see what properties are available nearby and at what cost to rent. Online retailers and early-stage entrepreneurs have the most to gain from this type of program. But there are major benefits to the city, as well. Association for Enterprise Opportunity.

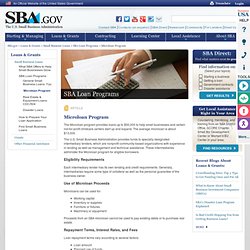

Microenterprise publications. Microenterprise and microfinance organizations. Microloan Program. The Microloan program provides loans up to $50,000 to help small businesses and certain not-for-profit childcare centers start up and expand.

The average microloan is about $13,000. The U.S. Small Business Administration provides funds to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending as well as management and technical assistance. These intermediaries administer the Microloan program for eligible borrowers. Eligibility Requirements Each intermediary lender has its own lending and credit requirements. Use of Microloan Proceeds Microloans can be used for: Working capital Inventory or supplies Furniture or fixtures Machinery or equipment Proceeds from an SBA microloan cannot be used to pay existing debts or to purchase real estate. Repayment Terms, Interest Rates, and Fees Loan repayment terms vary according to several factors: The maximum repayment term allowed for an SBA microloan is six years.

Application Process. Small Business Loan Qualifications: Alternative Credit : Accion East and Online. About Our Small Business Loans : Alternative Credit : Accion East and Online. Home Español Português View this Success Story. Kiva New Orleans, ASI FCU Team Up to Rebuild a Ravaged City. Kiva's Microloans Available for LA Small Businesses. A non-profit organization responsible for millions of dollars in loans around the world is bringing its microlending to the small businesses of Los Angeles.

The June jobs report -- which revealed employers added 80,000 jobs that month, keeping the unemployment rate at 8.2 percent -- was another sign the economic recovery is in a summer slump.His group has now partnered with Kiva, a non-profit lending site located in 60 different countries around the world. But microlending is part of a push to support local small-business owners who are finding new ways to succeed in a struggling economy. Nearly a year ago, Yesenia Monroy opened Cafe 22, a natural foods breakfast and lunch spot in Boyle Heights. "Our dream was to bring something fresh and healthy to a desert of fresh food," Monroy said. The pregnant mother of two says it is a dream almost not realized because banks refused to offer her a $15,000 loan. For the $5,000 she needed to create that position, Monroy turned to the Internet.

Launches Online Microfinance in the United States. Kiva.org brings its global, online micro-lending platform to the United States at a financial tipping-point for many small businesses.

Small businesses represent more than 87 percent of all businesses in the United States, and, on average, these microenterprises are responsible for 900,000 new jobs created per year.(1) Despite these statistics, more than 10 million business owners faced difficulty obtaining business capital -- even before the credit crisis and economic slowdown. Beginning today on Kiva.org, through partnerships with local microfinance institutions ACCION USA and Opportunity Fund, individuals will be able to browse and lend to small businesses across the United States. Through Kiva's website (www.kiva.org), a loan of $25 can be made to support an entrepreneur, and the specific progress of the loan can be tracked, from initial funding to repayment. Loans that change lives. Microfinance.

My Story I am adiligent, hardworking, honest and respectful.

Brought up in a Christian background. In my upbringing, I was taught to be independent and it was a great motivation especially having to learn it first hand from my elder siblings with both of my parents. This more so influenced us greatly as their young ones. we were taught behavioral norms as well as good Christian practices. this enabled me to have a great focus in life,to get to know that the good things in life don’t just come in a silver platter, we all have to work, not only hard for them, but smart to achieve them.

This was a great motivation thus it gave me self-drive and a sense of direction in life. Who wrote this? About My Business CHARCOAL BRIQUETTES BUSINESS Charcoal recycling is a business I started in 2011 December, in Nyeri and it has really grown over the last one year. Hatch Detroit - Crowd Entrepreneurship..Reinventing Detroit! Kiva Detroit. Champion small businesses in Detroit, the first Kiva City!

Confessions of a Microfinance Heretic: How Microlending Lost Its Way and ... - Hugh Sinclair. The Detroit Micro-Enterprise Fund.