Auditor General Report: Aboriginal Programs To Deal With Residential Schools, Diabetes Have Gone Awry. OTTAWA - The federal auditor general says two of the government's key pillars meant to improve the lives of aboriginal peoples have gone awry because of infighting, poor co-ordination and lack of planning.

Auditor general Michael Ferguson says attempts to deal with the fallout of the residential school system are a mess as the Truth and Reconciliation Commission bickers with the federal government over what historical documents need to be provided and how they should be preserved. And he says Ottawa's plans to deal with rising rates of diabetes — especially on First Nations reserves — are showing no results because government programs aren't working together or checking the effectiveness of their projects. At stake are the mental and physical health of First Nations families across Canada at a time when aboriginal communities are crying out for better treatment from the federal government. Consumer Debt Canada: Bankruptcy Risk Greatest For 'Pre-Retirement' Group, Review Finds.

“Pre-retirement” Canadians aged 50 to 59 are taking on an alarming amount of debt and are most at risk of bankruptcy, according to a new study that examined some 7,000 insolvency filings. Bankruptcy trustees Hoyes, Michalos & Associates reviewed filings from 2011 and 2012 and found the average bankrupt Canadian is a 43-year-old man with more than $61,000 in debt. That’s about three times the national average of about $18,000 of non-mortgage debt per Canadian. The average age of bankrupt Canadians shot up from 41 years in 2009, while the average amount owed rose two per cent in two years. And 57 per cent of Canadians who filed for insolvency were male. But the group with the highest debt levels were those aged 50 to 59, whose unsecured debts — including credit cards, personal loans and other forms not backed by assets — exceeded $84,000, the study found.

Banks got $114B from governments during recession - Business. Canada's biggest banks accepted tens of billions in government funds during the recession, according to a report released today by the Canadian Centre for Policy Alternatives.

Canada's banking system is often lauded for being one of the world's safest. But an analysis by CCPA senior economist David Macdonald concluded that Canada's major lenders were in a far worse position during the downturn than previously believed. Macdonald examined data provided by the Canada Mortgage and Housing Corporation, the Office of the Superintendent of Financial Institutions and the big banks themselves for his report published Monday. It says support for Canadian banks from various agencies reached $114 billion at its peak. That works out to $3,400 for every man, woman and child in Canada, and also to seven per cent of Canada's gross domestic product in 2009. The figure is also 10 times the amount Canadian taxpayers spent on the auto industry in 2009.

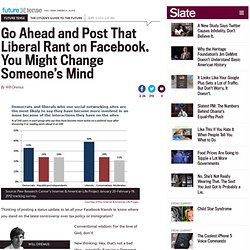

CMHC mortgage program aided banks. Liberals more open minded to change. Thinking of posting a status update to let all your Facebook friends to know where you stand on the latest controversy over tax policy or immigration?

Conventional wisdom: For the love of God, don’t! New thinking: Hey, that’s not a bad idea—especially if you’re a Democrat. That, at any rate, is one possible takeaway from a new survey by the Pew Internet & American Life Project. TraceyKent : SenZimmer's wife living off... RBC flouted customer data sharing rules, brokers allege. Canada’s insurance brokers are asking regulators to look into the possibility that Royal Bank of Canada is sharing customer data with its insurance arm.

The move escalates the already heated battle between the brokers, who make their living selling insurance, and the banks, which are doing all they can to muscle further into the business. RBC, the country’s largest bank, says it is complying with regulations. The complaint stems from a marketing letter, which appears to be a form letter, that RBC Insurance sent to an individual in Alberta. “As an RBC Royal Bank credit card client, you already have a relationship with RBC Royal Bank,” the letter states. “Now you can trust RBC Insurance for your insurance needs.” The letter goes on to note that “if you use your RBC Rewards credit card to pay for your insurance premiums you can earn RBC Reward points.”

As it turned out, this particular customer was a member of the Insurance Brokers Association of Canada. ‘Denounce Harper’ Twitter-trending on Canada Day. Harper government rejects economist's prescription for financial crisis warning. 5 Even Worse Lies from Accelerated Christian Education « Leaving Fundamentalism. No, I do not respect your religious beliefs. Harper's Chopping Block. By Judith Szabo and Pearl Eliadis (from X-Ray Magazine Organizations and watchdogs whose staff have been fired, forced out, publicly maligned, or who have resigned in protest: • Canada Firearms Program (Chief Supt.

Marty Cheliak, fired) • Canadian Wheat Board (Adrian Measner, fired) • Canadian Nuclear Safety Commission (Linda Keen, fired) • Foreign Affairs (Richard Colvin, silenced by prorogation) • Military Police Complaints Commission (Peter Tinsley, forced out) • Ombudsman for the Department of National Defence and the Canadian Forces (Yves Coté, resigned) • Parliamentary Budget Officer (Kevin Page, publicly maligned) • RCMP Police Complaints Commission (Paul Kennedy, fired) • Rights & Democracy (Rémy Beauregard, died of heart attack) Tories fear budget-bill showdown burnt substantial political capital. Dave Thomas: Stephen Harper 'Probably The Worst Thing That's Ever Happened To Canada' SCTV alumnus Dave Thomas is not a fan of Stephen Harper.

In an interview for the podcast of author and broadcaster Ken Plume, Thomas blasts the prime minister for catering to the U.S. and big business. "Harper is probably the worst thing that’s ever happened to Canada," Thomas says. Quebec Emergency Law an Attack on Freedom of Assembly and Expression, say Critics. [Updates below] The Quebec government has introduced legislation which they say is necessary in order to restore social order during the ongoing student strike, but which critics are denouncing as threatening the right to protest in Quebec.

Quebec Emergency Law an Attack on Freedom of Assembly and Expression, say Critics. Protesting NATO: What to Know About the Secret Service and H.R. 347. Chief Papaschase.