Money Smart Online. Money IQ Quiz « Money Smart Online. Recipes for Financial Fitness. Financial fitness means a lot of things.

And it’s not just about money. Think of people you know who are physically fit, or the athletes you admire most. The types of things they do for physical fitness are similar to the types of things you’ll do for financial fitness. Athletes practice good nutrition every day to stay fit. They also learn new skills so they can become more fit. Challenge, Action, Results Athletes also deal with challenges, take action, and get results. In your quest for financial fitness, you also have to deal with challenges (get finances under control), take action (pay bills on time; reduce debt), and get results (improve credit and cash flow).

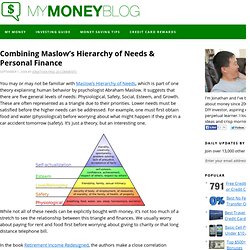

This Web site shows you how credit, financial fitness, and owning a home are all connected. Let's get started! Managing Your Money. Try It! Move Over, Maslow – Here’s the Personal Finance Hierarchy of Needs. Combining Maslow’s Hierarchy of Needs & Personal Finance. You may or may not be familiar with Maslow’s Hierarchy of Needs, which is part of one theory explaining human behavior by psychologist Abraham Maslow.

It suggests that there are five general levels of needs: Physiological, Safety, Social, Esteem, and Growth. These are often represented as a triangle due to their priorities. Lower needs must be satisfied before the higher needs can be addressed. For example, one must first obtain food and water (physiological) before worrying about what might happen if they get in a car accident tomorrow (safety). It’s just a theory, but an interesting one. While not all of these needs can be explicitly bought with money, it’s not too much of a stretch to see the relationship between this triangle and finances. In the book Retirement Income Redesigned, the authors make a close correlation between the hierarchy of needs and planning for retirement. The new levels: Mortgage Rates Credit Cards Refinance Home CD Rates by Bankrate.com.

Cost of Living comparison calculator. 5 Websites to Check Before You Shop Online. (PriceGrabber) Shopping online has its undisputable benefits: it can save you gas, time and money, not to mention you can do it in your pajamas.

The problem is, with so many online retailers to choose from, the whole process can become overwhelming rather than a time-saver. Why buy online if doing so is a whole new skill in and of itself? Cutting through the online clutter is easy if you start out your shopping trip with the five websites below. PriceGrabber.com Everyone tells us to comparison shop online, but few offer much in the way of concrete, usable advice. One website that makes comparison shopping much simpler is PriceGrabber.com.

Milo.com (Milo) One of the most promising up-and-comers in the online shopping world is Milo.com. Driven by their slogan “Find it Local, Get it Now,” Milo vouches that any product for which it finds a price is available right now from the local retailers it lists. CoolSavings.com (CoolSavings) At CoolSavings, the message is “Savings Made Simple.” (ShopAtHome) My Journey to Millions. One of the most common questions people face today in the area of personal finances is whether it is better to enjoy your money today, or save for tomorrow.

It often feels like the experts are suggesting that you must choose one or the other and that there is no compromise. However, this is not actually true and if you manage your money correctly and take advantage of high interest savings accounts and 0% deals on credit cards then you can do both. So the idea that the two ways of living are mutually exclusive is not accurate.

You can enjoy life and still put money into savings so that you build a safety net for the future. After all, you have worked hard for your wage. That is why at the end of the month, every restaurant and bar in the city is much busier than during the month. On the other hand, when you put your hard earned money into some form of savings account, you will experience delayed gratification and reap the benefits in the future. The future probably seems very far away. Create a Spending Plan. Creating a spending plan may be the single best thing you can do for yourself financially.

It's almost impossible to build a strong financial future for yourself when you don't know where your money comes from and where it goes. And that's what a spending plan, or budget, is: your plan for your money. Creating a spending plan may not be the most fun thing to do, but it's not difficult, and it can be very rewarding. The many benefits to having a working spending plan include: