Effective tax rates. Economist Explains Obama’s Job Act In One Simple Chart. Small-business voices: Owners talk regulation, health care and red tape - chicagotribune.com. September 08, 2011|By Kevin G.

Hall, McClatchy/Tribune news Politicians and business groups often blame excessive regulation and fear of higher taxes for tepid hiring in the economy. However, little evidence of that emerged in a random sample of small-business owners across the nation. "Government regulations are not 'choking' our business, the hospitality business," said Bernard Wolfson, president of Hospitality Operations in Miami, told The Miami Herald.

"In order to do business in today's environment, government regulations are necessary and we must deal with them. The U.S. When it's asked what specific regulations harm small businesses — which account for about 65 percent of U.S. jobs — the Chamber of Commerce points to health care, banking and national labor. "When you look at regulations in many respects, what a lot of people don't take into account is their secondary impacts," said Giovanni Coratolo, vice president of small-business policy for the U.S. Then there's Rip Daniels. Top 1 Percent Control 42 Percent of Financial Wealth in the U.S. – How Average Americans are Lured into Debt Servitude by Promises of Mega Wealth. Many Americans are not buying the recent stock market rally.

This is being reflected in multiple polls showing negative attitudes towards the economy and Wall Street. Wall Street is so disconnected from the average American that they fail to see the 27 million unemployed and underemployed Americans that now have a harder time believing the gospel of financial engineering prosperity.

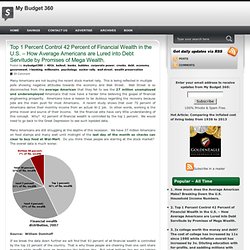

Americans have a reason to be dubious regarding the recovery because jobs are the main push for most Americans. A recent study shows that over 70 percent of Americans derive their monthly income from an actual W-2 job. In other words, working is the prime mover and source of their income. Many Americans are still struggling at the depths of this recession. Source: William Domhoff If we break the data down further we will find that 93 percent of all financial wealth is controlled by the top 10 percent of the country. The above daily poll asks Americans about their view on the health of the economy.

Ten Years of Capital Gains Tax Cuts Proves: Rich Win, You Lose. Why are "capital gains" taxes so much lower than taxes on other income? The reason capital gains taxes are lower is because most of the income of the rich is from capital gains. And the reason most of the income of the rich is from capital gains is because capital gains taxes are lower. Our System "Capital gains" are the gains, or profits, made from the investment of capital -- the big pools of money that a few of us have the great responsibility and burden of being stuck with. The theory is that the few among us who have bundles of money (capital) use that money to start businesses or buy stocks or property (or race horses) and thereby "create jobs.

" If the value of the business or property (or race horses) goes up those wealthy few make even more money (gains). Incentives Government Interference Job Creation Effect Of Cutting Capital Gains Taxes In 2001 these special low tax rates for the very rich "job creators" were made even lower. Because they're rich!