Instapaper. Apple Is Not Worth $460. Yes I bought Apple (AAPL).

Who would have guessed? I don't like the company. I don't like their products. But I do like it as an investment. The main topic covered everywhere on the internet relates to the lack of innovation which is leading to lower priced products, lower margins, lower profitability and ultimately death. All are valid points, but none of them concern me. The common value investing question is whether the company will be around in 10 years and if it is too hard to tell, then it is a pass.

My answer: Yes. Simple Investing Thesis My reason for investing in AAPL is simple and most likely too simplistic (or dumb) for most. Instead, AAPL at the moment is a classic case of "heads I win, tails I don't lose much. " Seth Klarman also referred to this as downside protection investing. Here are the reasons I bought AAPL. Downside protection: The balance sheet protects the business from going bankrupt.

Receive future articles by this author via email: Follow Jae Jun (2,657 followers) How To Properly Think About Stock Prices In Today's Volatile Markets. Price volatility is an unavoidable aspect of investing in common stocks.

During periods when emotions are dominating reason, price volatility can become more pronounced than is normal during calmer times. The insidious part of this fact is that the more volatile stock prices are, the more fear and stress they generate, which only feeds even greater volatility. Of course, the same can be said when greed raises its ugly head. The purpose of this article is to provide some logic and reason that can be applied to stock price volatility that simultaneously weakens its potential damage. However, in order to accomplish my objective, it is imperative that the reader be willing to consider what I believe is the undeniable reality that stocks are often mispriced by Mr.

Stock Prices are Often Pathological Liars. The Value Line Investment Survey. Have you ever opened the statement that your mutual fund company sent to you, then looked at the returns and thought, "I could do better than that"?

It's an increasingly common feeling, as the returns generated by many equity mutual funds often leave investors frustrated. If you want to try your hand at picking stocks but don't know where to start, the Value Line Investment Survey can help. The SurveyThe Value Line Investment Survey consists of professional research and recommendations on approximately 1,700 stocks. According to Value Line, this represents "… approximately 95% of the trading volume of all stocks traded in U.S. markets …" The Survey also provides weekly updates on the financial markets, recommended portfolios, developments involving covered securities and special topical reports.

For would-be stock pickers, Value Line provides an easy way to start your research. SEE: How To Pick A Stock Next, you'll want to read, "A Quick Study Guide. " Value Line - The Most Trusted Name in Investment Research. Is the Stock Market Cheap? Is the Stock Market Cheap?

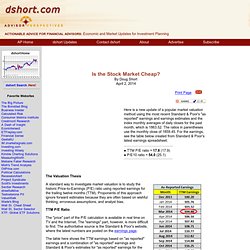

By Doug Short April 2, 2014 Here is a new update of a popular market valuation method using the most recent Standard & Poor's "as reported" earnings and earnings estimates and the index monthly averages of daily closes for the past month, which is 1863.52. The ratios in parentheses use the monthly close of 1859.45. For the earnings, see the table below created from Standard & Poor's latest earnings spreadsheet. ● TTM P/E ratio = 17.8 (17.9) ● P/E10 ratio = 54.0 (25.1) The Valuation Thesis A standard way to investigate market valuation is to study the historic Price-to-Earnings (P/E) ratio using reported earnings for the trailing twelve months (TTM).

TTM P/E Ratio The "price" part of the P/E calculation is available in real time on TV and the Internet. The table here shows the TTM earnings based on "as reported" earnings and a combination of "as reported" earnings and Standard & Poor's estimates for "as reported" earnings for the next few quarters.

P 500.