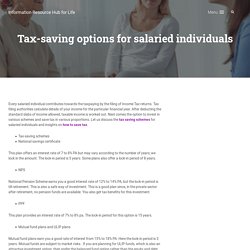

Tax-saving options for salaried individuals. Every salaried individual contributes towards the taxpaying by the filing of Income Tax returns.

Tax filing authorities calculate details of your income for the particular financial year. After deducting the standard slabs of income allowed, taxable income is worked out. Next comes the option to invest in various schemes and save tax in various proportions. Let us discuss the tax saving schemes for salaried individuals and insights on how to save tax. Tax-saving schemesNational savings certificate This plan offers an interest rate of 7 to 8% PA but may vary according to the number of years; we lock in the amount. National Pension Scheme earns you a good interest rate of 12% to 14% PA, but the lock-in period is till retirement. How to buy life insurance during COVID-19 time? A trapeze artist at circus needs a net below while performing dangerous stunts from height for safety.

Motor car driver needs an airbag to keep safe from untoward accidents. In the same way, driving a family needs financial safety arrangements in case of emergencies. Let us take a dig at what is life insurance, how life insurance policies can take care of you and your family during stormy conditions of life. Let us study are various life insurance types and which life insurance policy is right for you to handle difficult situations. A life insurance policy provides financial support to a family in case of the untimely demise of the policyholder. Introspect your finances Uncertainties due to COVID-19 have made us realize the importance of financial planning. Few types of life insuranceTerm life insurance policy. 4 Investment options strengthening your retirement income. Retirement plans are important because of the following reasons There would be no steady flow of income after retirement.

It would affect the usual lifestyle one would be leading before retirement.There could be heavy expenses as compared to the less income.Savings would be less.Health and hospitalization expenses would cause strain on the savings as there would be no more health benefits/coverage for self and family provided by the employer if any.The social security benefits of pension or health care facilities would be less.Financial cause and worry could lead you to stress and depression problems. Planning for retirement needs financial introspection. You have to work on the various expenses that you are likely to incur after retirement. Many investment companies provide the tool of retirement planning calculator, oryou can work out your monthly running expenses, liabilities and arrive at a monthly figure and invest accordingly.

National savings certificate Like this: Like Loading... 5 Tips for safeguarding your child’s future during an uncertain time – Telegraph. For every parent, their child is the cynosure of eyes.

And with the bundle of joy, every child comes with a lot of responsibilities in terms of their upbringing, education, profession, and settling them down. As a parent, it is your responsibility to plan for their education from the early days. With rising inflation and education expenses, it is always recommended to go for a child insurance plan to make your child, the best individual they can be. Newborn care: Understanding the dos and don'ts - My Medicare For Health Benefits. Parenthood is one of the most magical seasons of human life.

Parents experience a range of emotions right from happiness to fulfillment to joy and many times even exhaustion. And yet, the weariness fades away at the sight of your baby. However, one challenge which you may face as new parents face is decoding your baby’s needs. As new parents you may be often perplexed and have tons of questions when dealing with your little one. Don’t worry, in this article, we will look at some dos and don’ts which you ought to keep in mind as a part of the ‘newborn care’ routine. Breastfeeding: It’s normal if you have any struggles with breastfeeding and understanding what lactation is all about. Dos: Begin the nursing of the baby within the first few hours of the birth. Don’t: Don’t worry or stress if you are unable to breastfeed your baby in the first hour after the delivery. Swaddling the baby: FAQs about VBAC Delivery.

If you’ve had a cesarean or C-section last time, you may want to know if going for a natural birth could be an option for you, this time around.

Conceptually, and to an extend practically too, vaginal birth after C-section (VBAC) is possible for many women. However, there are several factors which you need to consult your gynecologist before your VBAC delivery. In the entire process, the safety for you and your baby is paramount and this necessarily should be sthe deciding factor. For some women, vaginal birth after a C-section can put them at a higher risk of complications.

5 reasons you need a health check-up as you near Menopause. There have been many fears encircling the menopausal phase.

Some are myths, while the rest are repercussions of not being prepared for the phase. Women’s health check-up allows you to foresee the oncoming phase and be better prepared for it. Some of the reasons why a health check-up as you near your menopausal phase are listed below.