SSI Spotlight on Trusts. Special Needs or Supplemental Needs Trusts — World Institute on Disability. Special Needs Trusts. If you want to leave money or property to a loved one with a disability, you must plan carefully.

Otherwise, you could jeopardize your loved one's ability to receive Supplemental Security Income (SSI) and Medicaid benefits. By setting up a "special needs trust" in your will, you can avoid some of these problems. Owning a house, a car, furnishings, and normal personal effects does not affect eligibility for SSI or Medicaid. Using Trusts for SSI Eligibility. Supplemental Security Income, or SSI, as it is commonly referred to, is a federal disability benefit.

Folks who are eligible for SSI benefits include those who are over 65, blind, or disabled. But SSI is available only to people who meet the Social Security Administration’s (SSA) strict income and asset limits. These limits can be a particular problem for people who are on SSI, or are applying for SSI, if they experience a financial windfall such as an inheritance or a lawsuit settlement, because their eligibility for benefits could end. However, there are ways to place these assets into a trust that can help preserve an individual's eligibility for SSI while allowing small improvements to the individual's lifestyle. Let's first look at what the limits are for income and assets (the SSA refers to these assets as resources), and then we'll discuss SSI trusts.

Who Can Benefit From a Special Needs Trust? Special needs trusts are designed to enhance the quality of life of a person with a disability by maximizing the resources available to them.

It preserves eligibility for Supplementary Security Income (SSI) and Medicaid (which pay for food, shelter, and medical care but little else). The special needs trust can then pay for all other additional things that make life better. This type of trust can work for a variety of people – including people with permanent or temporary special needs, people who may someday have special needs, and anyone who receives SSDI or Medicare. Learn more about How Special Needs Trusts Work. Comparing Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) – Special Needs Alliance. January 2011 - Vol. 5, Issue 2 The Voice is the e-mail newsletter of The Special Needs Alliance.

This installment was written by Special Needs Alliance members Ann Butenhof and Judith Bomster, of Butenhof & Bomster, PC, in Manchester, New Hampshire (www.butenhofbomster.com). Ann and Judith focus their practices on estate planning, special needs planning, elder law and probate and trust administration. Both are members of the National Academy of Elder Law Attorneys and the local New Hampshire chapter (“NH NAELA”). Ann is a Certified Elder Law Attorney, a Fellow of the American College of Trust & Estate Counsel, has been listed as one of New Hampshire’s Top Lawyers since 2003, and has been designated one of New England’s Super Lawyers. What Are Special Needs Trusts? Special Needs Trusts - How to Avoid Losing SSI and ... Special needs trust. A special needs trust is a trust designed for beneficiaries who are disabled, either physically or mentally.

It is written so the beneficiary can enjoy the use of property that is held in the trust for his or her benefit, while at the same time allowing the beneficiary to receive essential needs-based government benefits.[1][2] In addition to the public benefits preservation reasons for such a trust there will be administrative advantages of using a trust to hold and manage property intended for the benefit of the beneficiary if the beneficiary lacks the legal capacity to handle his or her own financial affairs. Special needs trusts are sometimes known as supplemental needs trusts in the United States. Throughout the world[edit] Overview[edit] Special needs trusts can provide benefits to, and protect the assets of, the physically disabled or the mentally disabled. References[edit] Further reading[edit]

SSI BENEFITS AND SPECIAL NEEDS TRUST. California - Trust Funds. Trust Funds Special Needs Trust Funds A Special Needs Trust (SNT), sometimes called a Supplemental Needs Trust, is a legal arrangement in which a person or organization (like a bank) manages assets for a person with a disability.

The person with the disability is called the “beneficiary” and the person who is managing the assets is the “trustee.” Many kinds of assets can be put into a trust, such as cash, stocks, bonds, and real estate. Some Frequently Asked Questions About Special Needs Trusts - CANHR. By Peter S.

Stern, Esq. I get many phone calls from attorneys and members of the public asking questions about special needs trust situations. Some require a lot of work, and often lead to case referrals, while others can be answered quickly (and accurately, I hope!) With a brief phone call. What follows are some typical questions I’ve received, and my answers: A Special Needs Trust Provides for Disabled. If someone with special needs depends on you for financial resources, your estate plan should address how that support will continue when you're no longer around.

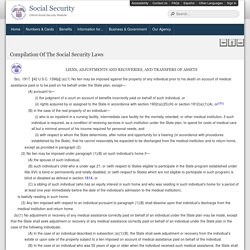

A special needs trust allows you to leave money for the care of your loved one that won't count against Supplemental Security Income, or SSI, and Medicaid benefit thresholds, because the beneficiary doesn't own the assets. To determine eligibility for SSI, the federal government counts any resources above $2,000. Medicaid income eligibility limits vary by state. Some states automatically approve anyone receiving SSI benefits; others have their own income and asset limits. Anyone who qualifies as disabled under the Social Security Act can be the beneficiary in a special needs trust, says elder law attorney Amos Goodall in State College, Pa. Te lewis.authcheckdam. Social Security Act §1917. Sec. 1917. [42 U.S.C. 1396p] (a)(1) No lien may be imposed against the property of any individual prior to his death on account of medical assistance paid or to be paid on his behalf under the State plan, except— (A) pursuant to— (i) the judgment of a court on account of benefits incorrectly paid on behalf of such individual, or.

The Special Needs Trust. The special needs trust can be your primary savings tool for your child’s future.

It allows you to properly transfer savings to your child without jeopardizing his or her ability to receive government benefits. Several ways to fund the trust are presented below. Also referred to as a “supplemental care trust” the special needs trust provides a way for you to supplement government benefits such as Medicaid and Supplemental Security Income (SSI). The trust can be set up so it functions while you’re alive, or begins to function after your death. Here’s the way it works. The most important benefits of the trust are maintaining your child’s financial well-being and his or her long-term eligibility for government assistance. “I feel better knowing that my family will have enough money to take care of themselves in case something should happen to me.

—Chris Stevens, father of Ali and Jacob. The Impact of Special Needs Trusts on Eligibility for Subsidized Housing – Special Needs Alliance. March 2011 - Vol. 5, Issue 4 The federal and state governments subsidize housing for elderly persons and individuals with disabilities. The subsidies come in the form of below-market rent units in public and private housing developments and Section 8 vouchers for use in the private market. Tenants in subsidized housing typically pay rent of 30% to 40% of monthly adjusted income. Special Needs%20Trusts%20Drafting%20and%20Administration%20Issues.

The Problem With Special Needs Trusts. {*style:<i>*}{*style:<i>*}“Floyd doesn’t need to be on Medicaid,” she said. “Floyd needs a home.” ... {*style:</i>*}{*style:<br>*}{*style:<i>*}{*style:<br>*}Read more here: more here: why a less restrictive trust wasn’t set up, Giordano said the decision was made jointly among himself, Rudolf and Cogburn. “It was only because he had public benefits (related to his disability); that was the sole motivating reason,” Giordano said. “Hindsight is great.” {*style:</i>*}{*style:<br>*}{*style:<i>*}To gain flexibility, Brown would forfeit SSI and Medicaid benefits.

Special Needs Trust and Social Security. First Five Things to Do: Special Needs Trusts. By Terri Mauro Updated February 27, 2015. If you've been to meetings about future planning for your child with special needs, or spent much time with other parents, or read articles on estate planning, you've probably gotten the message that you have to put money in a Special Needs Trust so that your adult child does not lose services due to maximum income requirements.

And maybe you're dragging your feet on that, reluctant to take on another complicated chore. To take some of the trepidation out of the task, I asked Joanne Marcus, executive director of Commonwealth Community Trust (CCT), to walk us through the choices we'll need to make in getting a trust set up. CCT is a nonprofit organization established in 1990 by concerned citizens and parents of children with disabilities to provide an effective and affordable administration of either a Special Needs Trust or Pooled Disability Trust and act as the trustee in managing the disbursements. Continue reading below our video Play Video 1. Notes on Special Needs Trusts - CANHR. Notes on Special Needs Trusts By Peter Stern, Esq. How many times have you heard a client express regret that her son has bipolar disorder, is on SSI, and she doesn’t know what to do in her estate plan other than leave everything to the two daughters, hoping they will take care of the son?

This is not a refrain I hear much in my office any more, because special needs planning has become routine, if not a standard of practice, in the past decade. Sb pooled asset trusts. SpecialNeedsAnswers.