Hypotheque Soulanges

Hypotheque Soulanges specializes in Montreal commercial Real Estate and Mortgage transactions. Whether you need a mortgage loan, mortgage renewal, or mortgage refinancing in Montreal & Vaudreuil, just contact us today.

Refinancement maison, financement renovations, ligne de credit. Hypothèque Soulanges- Meilleur Courtier Hypothécaire, West Island- Courtiers Financiers Indépendants de Vaudreuil. À propos de nous : Courtiers financiers indépendants de Montréal et Vaudreuil, Québec Canada. Avantages d'envisager le refinancement pour les rénovations, Refinancer la maison. How Do I Find a Mortgage Broker West Island? Everyone’s dream is to own a place to call home.

However, due to the rising costs of buying and constructing houses, this is a far-fetched dream for many. However, with mortgage financing, it would be easy to make such a dream come true. To get a reliable Mortgage Broker, West Island, and own your home easily, consider the quick guide below. Check the Internet. Benefits of Considering Refinancing for Renovations, Refinance House. Best Mortgage Lender, Top Mortgage Brokers, Mortgage Calculator.

Hypotheque Soulanges- Best Mortgage Company in Montreal. Comment sélectionner le meilleur professionnel hypothécaire. How to Select the Best Mortgage Broker in Montreal. Search OnlineThe internet is full of free information about different service providers.

If you are looking for their best Montreal Mortgage Professionals, you can be sure to get them with an online search. Searching for Montreal mortgage lenders would be one example, and it would return dozens of listings. Go through them and select the one that fits the bill. Look for Referrals and RecommendationsIf your friends, family members, or neighbors have taken a mortgage before, they can offer good referrals. Also, they may have numerous recommendations to a good Mortgage Broker, Montreal. How to Choose Best Mortgage Company Montreal. If you are thinking of taking a mortgage loan, you should get the right help to navigate the industry carefully.

It may overwhelm you, and if you are not careful, you may make some long-term mistakes. To navigate it safely, make sure to find a reliable company first. Below are tips you may use to find the Best Mortgage Company, Montreal. 4 Benefits of Using Top Mortgage Brokers in Vaudreuil. 4 avantages de faire appel aux meilleurs courtiers hypothécaires à Vaudreuil. 4 Benefits of Using Top Mortgage Brokers in Vaudreuil. When it comes to getting a mortgage, it may overwhelm most people, especially those who have never tried it before.

It may be daunting because of the many processes one has to go through and all the regulations governing the industry. However, not all is scary since the industry has mortgage brokers to help those who may be stuck. If you are thinking of taking a mortgage, then you may need to use a broker. The use of Top Mortgage Brokers in Vaudreuil is not only convenient but helps you get better deals. You also enjoy the following benefits. Good Mortgage Broker, Montreal. À la recherche d'un prêt de courtier hypothécaire? Contacter l'Hypothèque Soulanges. How to Choose the Best Mortgage Company Montreal. If you want to take a mortgage, then you should research and do your homework well.

This should make your approach and plans easier and more fulfilling. However, if you are yet to find the Best Mortgage Company, Montreal, you must do due diligence to find the right one. Éléments à considérer lors de la recherche du meilleur prêteur hypothécaire près de chez moi. Things to Consider When Finding the Best Mortgage Lender near me. By Hypotheque Soulanges mortgage broker Montreal If you are buying a home, a mortgage will be a good idea.

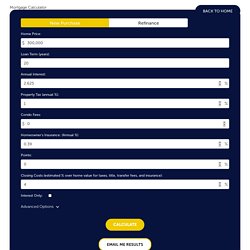

However, getting it is not easy, which means you have to do due diligence. Best Mortgage Brokers & Rates in Montreal at Hypotheque Soulanges. Back to home Mortgage Calculator Advanced Options keyboard_arrow_down.

Find the Best Mortgage Broker Vaudreuil. You can start by talking to people close to you and see if they can refer you to some of the best Montreal or Vaudreuil Mortgage Experts.

They can also recommend those ones that they may have more tru... st in. With their suggestions, you can be sure to have it easier when choosing a mortgage company you can trust. How to Find the Best Mortgage Broker Montreal. It can be a struggle and tricky affair trying to find a good mortgage adviser, leave alone a mortgage financier.

With the right advice, though, you can navigate the murky field and get the right access to the mortgage you need. You only need to get the Best Mortgage Broker, Montreal. Below are tips on how to find one. Comment trouver le meilleur courtier hypothécaire. Questions to Ask a Potential Mortgage Broker Montreal. Questions à poser à un courtier hypothécaire potentiel Montréal. Best Mortgage Lender, Top Mortgage Brokers, Mortgage Calculator. Meilleur Les courtisans hypothécaires résidentiels Montréal.

Pourquoi la SCHL a-t-elle imposé des règles strictes aux prêts hypothécaires? Comment contourner les nouvelles règles sévères du Canada en matière d'hypothèques. Why Did the CMHC Impose Tough Rules on Mortgages? The Canadian Mortgage and Housing Corporation is responsible for managing and overseeing dealings in the real estate sector.

It formulates and implements rules to be followed by lenders and homebuyers because financing is vital in the property market. Due to the ongoing pandemic, the CMHC has set rigid rules to limit borrowing. Listed below are its reasons. How to Get Around Canada’s Harsh New Mortgage Rules. The CMHC has imposed new mortgage rules. The rules make it harder for people of low income to get adequate financing at affordable rates. Luckily, you can get around these rules with expert strategies. The tighter borrowing rules imposed on July 1 have made it challenging for many Canadians to buy property.

The Canadian Mortgage and Housing Corporation (CMHC) announced its policy of reducing lending limits, restricting down payments, and demanding higher credit scores for buyers’ defaulting insurance from the agency. Get Best Mortgage Deal near You - Hypotheque Soulanges. Quelles sont les nouvelles règles hypothécaires imposées par la SCHL? Best mortgage company Montreal Interest free mortgage Montreal. Comment un emprunteur peut-il contourner les nouvelles règles de la SCHL? Best mortgage company Montreal Interest free mortgage Montreal.

What are the New Mortgage Rules Imposed by CMHC? By Hypotheque Soulanges mortgage broker Montreal The CMHC is striving to protect the real estate market by preventing unnecessary borrowing due to the pandemic. The failing economy will make it harder for most home buyers to pay their mortgages. To protect the buyers and the lenders, the CMHC has imposed new mortgage rules. The Covid-19 pandemic has affected the world, and in response, governments are looking for practical solutions to eliminate it. According to health experts, lockdowns were an effective tool in stopping its spread. What Borrowers Need to Beat the New CMHC Rules. The measures imposed by governments to curb the spread of the Covid-19 virus are causing a strain on the economy. Many people are losing their livelihoods and purchasing power. However, it provides a perfect opportunity for people to buy homes. It would help if you bypassed the new CMHC’s rules to get financing.

You will need the listed qualifications to get a mortgage. Credit scores. Mortgage Broker in Montreal, Vaudreuil Home Mortgage Experts. Best mortgage broker Montreal. The measures imposed by governments to curb the spread of the Covid-19 virus are causing a strain on the economy. Many people are losing their livelihoods and purchasing power. However, it provides a ... perfect opportunity for people to buy homes. It would help if you bypassed the new CMHC's rules to get financing. You will need the listed qualifications to get a mortgage. Credit scores Mortgage lenders are currently adjusting their rates based on various conditions.