Like to play Music & Optimizing the Google with the best SEO Practice.

Jet Airways - Travel Blog. Mediclaim Policy - Health Suraksha Top Up Plus - HDFC ERGO. HDFC ERGO’s Health Suraksha Top Up Plus is what you can turn to when you feel you want something more from your medical insurance policy.

Our Top Up plan not only supplements your primary health insurance cover at a low cost, but also comes with a host of additional benefits. Our Health Suraksha Top Up Plus offers benefits to suit your needs with no room rent restriction, no sub limits and the option of lifelong renewability. If the need arises, owing to job change, retirement etc, we would be glad to convert your Top Up policy into HDFC ERGO Health Suraksha policy at any time. You would also be able to carry forward all the accrued continuity benefits of the Top Up policy.

Our policy offers you additional sum insured to counter any medical emergency or prolonged illness, whereby the existing cover offered by primary health policy may fall short. #Subject to the change in Tax Laws For details, please refer to policy terms and conditions FAQs. Car Insurance - Buy & Renew Car Insurance Online. Private Car Insurance has to be one of the first things you buy after your car.

A financial safeguard for a large variety of situations, car insurance policy becomes one of the most important purchases you’ll make. Whether it’s a natural disaster such as an earthquake or flood; or somebody damages or steals your car, HDFC ERGO Car Insurance plan will take care of it all. With compulsory factors such as third party liability, you can ensure that any damage done to another person’s property by your vehicle will be covered in a claim. A car is an asset that everyone is proud to own, often it’s a large milestone in a lot of people’s lives. HDFC ERGO Car Insurance ensures that you and your vehicle stay safe and secure.

A car insurance provides protection against losses that could arise from unforeseen incidents. Health Suraksha- Health Insurance Plan from HDFC ERGO. With the HDFC ERGO Health Suraksha health insurance plan, you get access to a network of more than 5000+ hospitals in the country for availing cashless hospitalization and health care facilities.

Health Suraksha offers a policy period of 1 year and 2 years with basic sum insured per year ranging from Rs 3 to 10 lacs. It covers in-patient treatments, pre-hospitalization expenses, 144 day-care procedures, domiciliary treatments and many such expenses incurred during treatment. Also, a pre-policy check is required only if the individual is above 45 years in age. In addition to these, HDFC ERGO Health insurance offers the benefit of Cumulative Bonus on completion of every claim-free year and reimbursement on health check-ups after completing 4 years of cash-less service. And along with that, you can avail benefits on Income Tax. Get the right Health Suraksha plan for you and your family with just one click. (* Subject to the change in Tax Laws) Travel Insurance - Buy Insurance Online at HDFC Ergo. A lot of planning is done before selecting a holiday destination abroad, international hotels, international flights, etc.

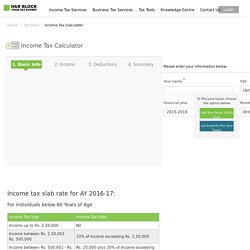

However, who will ensure that your vacation is a success? A travel insurance plan will ensure that your vacation is hassle-free. Whether you happen to lose your baggage or passport, or whether u need any kind of medical support on your trip, an overseas travel insurance will make sure that you get what you need. Income Tax Calculator for Online Tax Calculation. • A rebate of Rs. 2000 (Rs. 5000 form A.Y. 2017-18) is available for individual (who is resident in India) with income less than Rs. 5 lacs u/s 87A of Income Tax Act. • If you attain the age of 60 years (senior citizen) or 80 years (super senior citizen) anytime during this Financial Year, your age will be regarded as 60 years/ 80 years as the case maybe. • Education cess @ 3% of the total of Income Tax for all individuals will be applicable. • Surcharge of 12% (15% for A.Y. 2017-18) will be applicable if your total income exceeds Rs. 1 crore.

How to calculate TDS amount? In order to calculate the amount of TDS per month we need to calculate the salary for the year and deduct all the amounts that are exempt from taxes and other deductions that reduce the taxable income. E-File Income Tax Return. E-File Income Tax Return. E-File Income Tax Return.