Who's afraid of the euro crisis? After two major bailouts and a change in government, Greece is still struggling to reduce its debt mountain.

But how might the crisis in Greece spread out across Europe and what are the main fears for each economy? Greece Prime Minister Antonis Samaras Took office: June 2012 Big fear: Running out of money After a second parliamentary election in as many months, Greece's centre right New Democracy party has managed to cobble together a grand coalition with former arch opponents Pasok as well as the anti-austerity Democratic Left. New Prime Minister Antonis Samaras' big fear is the government will either fall apart, or run out of money (or both) before Christmas, which could precipitate an exit from the euro.

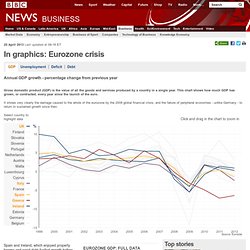

The coalition parties make strange bedfellows, and have agreed to push for softer terms - including slower spending cuts - from Greece's bailout lenders. Portugal Prime Minister Pedro Passos Coelho Took office: 21 June 2011 Big fear: Bank run But his work could be for nothing. Ireland Spain Italy. Eurozone in crisis in graphics - GDP. Continue reading the main story Spain and Ireland, which enjoyed property booms and rapid debt-fuelled growth before 2008, have failed to recover.

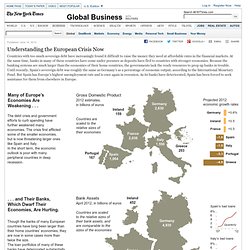

Latest data shows them back in recession this year. Notice that while Portugal and Italy did not experience huge dips in 2009, their GDP growth was very weak for much of the previous decade. For Portugal, this made the big infrastructure projects it was pursuing difficult to afford, while for Italy it made the government's enormous debtload harder to bear. Lastly, look at Greece, whose economy seems to have been driven into freefall by the government's austerity measures and the collapse in confidence in the country's future. Send us your feedback. Tracking Europe’s Debt Crisis - Interactive Feature. The Euro Zone Crisis: A Primer. Major Players in the European Debt Crisis - Interactive Feature. Understanding the European Crisis Now - Graphic. *Except Greece, which is for March The situation in Europe might be worse were it not for a system that was created to clear transactions between central banks.

That system is now providing loans to central banks of countries whose banks are suffering withdrawals. The money comes from the central banks of nations with healthier banks, like Germany, the Netherlands and Luxembourg. Germany already has substantial exposure to the weaker economies, which is one reason it has been reluctant to agree to issue pan-European bonds. Unemployment rates April 2012* Ratio of Gross Government Debt to Gross. Timelime of the financial crisis. Help Weeks Dec 29.

Timelines of Policy Responses to the Global Financial Crisis. Monetarypolicy2011en. The Financial Crisis Timeline. The "Surprising" Origin and Nature of Financial Crises: A Macroeconomic Policy Proposal by Ricardo J.

Caballero and Pablo Kurlat in Federal Reserve Bank of Kansas City Symposium, August 2009 The authors discuss three key ingredients for severe finanical crises in developed financial markets. Then they offer a policy proposal of tradable insurance credits to address a systemic crisis. “How Central Should the Central Bank Be?” A Comment by Christopher J. The Reserve Bank presidents are fully accountable to our democratic institutions and the decentralized structure promotes healthy debate on monetary policy and regulatory issues. Actions to Restore Financial Stability: A summary of recent Federal Reserve initiatives by Niel Willardson in The Region (Minneapolis Fed), December 2008 This article provides a summary of recent Federal Reserve initiatives designed to reestablish normal credit channels and flows in the wake of the current financial crisis.

An Autopsy of the U.S.