GARY JOHNSON

Georgette Saree - Buy Pure Georgette Sarees Online. Soft Silk Sarees - Shop for Soft Silk Sarees Online. Sarees - Buy Beautiful Indian Sarees Online at Best Price. Cotton Sarees - Buy Pure Cotton Saree Online. Best Child Investment Plan with saving schemes. ~Guaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

#Includes Reversionary bonuses which may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A terminal bonus if any, may also be payable at maturity or on earlier death. If the policy offers guaranteed returns, then these will be clearly marked “guaranteed”. Since the policy offers variable returns, the given illustration shows two different rates of assumed future investment returns.

^Capital Protection, Guarantees, Guaranteed Benefits : Your Guaranteed Maturity Benefit (GMB) will be set at policy inception and will depend on age, policy term, premium, premium payment term (PPT) and gender and may be lower than your Sum Assured on death. ICICI Prudential Life Insurance Company Limited. Child Plans - Best Child Insurance Education Plan Online. * Under this benefit, following the date of death of the life assured, provided all due premiums have been paid, units equivalent to the installment premium will be allocated by the Company on the subsequent premium due dates. This benefit is not applicable for the One Pay option. On death of the Life Assured, the following conditions apply: The Fund Value including Top up Fund Value, if any, will remain invested in the respective funds and portfolio strategies as on date of death of the Life Assured.Only the Fund Management Charge and Policy Administration Charge will be levied.

Units will be allocated as if Premium Allocation Charges are being deducted. Life Insurance Cover will not apply and mortality charges will not be deducted.The policy cannot be surrendered. ** Loyalty Additions are applicable from the 6th policy year onwards in the form of extra units at the end of every policy year. . $ Past performance is not indicative of future performance. Retirement Calculator - Online Retirement Calculator. Financial Calculator - Financial Tools in India. HRA Calculator - HRA Exemption Calculation Online. Income Tax Calculator - Calculate Income Tax Online.

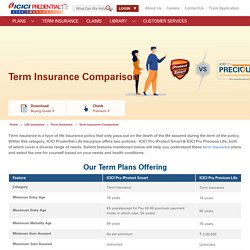

Term Insurance Comparison - Compare Best Term Plans Online. ^Critical Illness Benefit (CI Benefit) is optional and available under Life and Health and All in One options under ICICI Pru iProtect Smart.

This benefit is payable, on first occurrence of any of the 34 illnesses covered. Only doctor's certificate confirming diagnosis needs to be submitted. What is Term Insurance? 1 Top selling term life insurance planbought by customers through the website with our Zero-Paper-Process. Source: Company BuyOnline data - Dec 2015 till date. 2 The critical illness benefit is an accelerated benefit & the death benefit will be reduced by the critical illness cover paid to the policyholder. To know more about the illnesses covered, please refer to the sales brochure. 3 Available only under Life Plus and All in One option. Maximum amount that can be availed is ` 2 Crore and will be paid as a lump sum. 4 For Terminal illness, policy will terminate on payment of this benefit. 5 Tax benefit of `54,600 ( `46,800 u/s 80C and `7,800 u/s 80D) is calculated at highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium u/s 80C of `1,50,000 and health premium u/s 80D of `25,000. 6 Tax benefits under the policy are subject to conditions under Sec. 80C, 80D,10(10D) and other provisions of the Income Tax Act, 1961.

Term Insurance Plans - Best Term Plans Online in India. You can get a simple, quick and clear answer to this question by calculating your Human Life Value or HLV. HLV is an easy-to-use numeric method of calculating the amount of Life Cover that you may need. The basic thumb rule that can be used to find out your HLV is as follows: For example, if a 32 year old man has an annual income of 5 lakh, the ideal Life Cover for him would be 25 x 5 lakh = 1.25 crore.

*Please refer the product brochure to know more information regarding the illnesses covered, Accident Cover, and Total and Permanent Disability. ** Tax benefits are subject to conditions u/s 80C, 80CCC, 10(10A), 10(10D) and other provisions of the Income Tax Act, 1961. 17 per day is for a 25 year old healthy non-smoker male, availing a policy with a 15 year term. 6078 excluding taxes. Term Insurance - Best Term Plans & Policy in India 2019-20. *Source: ICICI Prudential Life Annual Report FY2018-19 **Our Life insurance policies COVID-19 claims, subject to applicable terms and conditions of policy contract and extant regulatory framework. ***The premium for a 22 year-old healthy male for a life cover of ₹1 crore for the ICICI Pru iProtect Smart – Life Option under the regular income payout option for a policy term of 19 years is ₹ 7046 p.a (inclusive of all taxes).

#The Average Claims Turn Around Time (TAT) for FY2019 for Death Claim (Individual) is 2.34 days* The TAT is calculated for Non-investigated claims from the last document received to disbursal date "The percentage saving computed is purely in terms of premium paid over the term (Difference between Limited Pay: 5 years and Regular pay) of the policy and does not account for time and other factors that may happen during this period. It is one of the many features that the product offers and you can opt for it based on your individual needs. $$ 3.

Source: 4.