American Dream Home Mortgage Inc

American Dream Home Mortgage gives you the personal attention you deserve and treats you with the respect due a valued customer. We pride ourselves in helping people find the best solution for their homebuying or refinancing needs. Make your American Dream Home become a reality with our home loan servicing options. Log on

Mortgage Loan Brokers Tampa, Florida. Best Loan Lenders in Florida for New Home. Money Saving Tips For Moving On A Budget. Most of the time moving is an exciting event because it is linked to an exciting life change such as starting a new job, expanding your family, downsizing for retirement, or some other major life change causing you to start a new adventure in a new location.

But as exciting as moving can be, what usually is not exciting about moving is all the expenses that come with it. There are a lot of expenses to budget for when making a move, from the security deposit or down payment to the moving van and boxes, so what can you do to ease the financial burden of moving? The good news is with some careful planning, you can create a moving budget that saves money and reduces the stress of moving. Here are a few tips to help you stay on budget when moving: Use Moving As An Opportunity To Let Go There are probably many things in your current home that you no longer use or need.

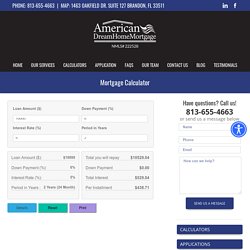

Pack Wisely Do As Much As Possible Yourself. American Dream Home Mortgage Inc 1463 Oakfield Dr. Suite 127, Brandon, FL, 33511. Mortgage Loan Calculator. Best Loan Lenders Florida. Mortgage Calculator. Close Loan Detail Since Principal and Interest are not the only factors of a loan we should include an estimate for other costs involved with a loan.

Your down payment was less than 20% of the loan, which means you will be paying PMI. Moodle. Home Repair Loan Lender Tampa Bay. FHA Approved Loan Lender. FHA 203k Streamline Rehab Program. Homes with cosmetic issues may be passed over by many buyers because they cannot afford to fix up the home in addition to the monthly mortgage payment.

That’s where the FHA 203K Streamline Rehab Program comes in. Rehab loans used to be very complicated – requiring a high credit score, repair or renovation plans, contractor restrictions, and resulted in having two loans to pay back. The streamline 203K is intended to help facilitate uncomplicated improvements or repairs to a home that does not require plans, consultants, engineers, architects, etc. With a 203k streamline mortgage you can get the home financed as well as additional cash (up to $35,000) to make renovations, all in a single loan amount. American Dream Home Mortgage Inc - Real Estate - Brandon - Brandon. Second Home Loan Lender Tampa Bay. Rental Property Loan Lender. Second home mortgage loan lenders in Tampa Bay, Florida. When buying a second home or an investment property, applying for another mortgage is a bit different than buying your first home.

If you are considering buying a second home or buying investment property, such as a rental home, there are a few things to keep in mind Different Loan Requirements You’ll will need to be able to cover the down payment (minimum of 20%) and all closing costs to buy an investment property or a second home. This is because mortgage insurance is not available for these types of properties. If you want to use your property’s rental income to qualify for the loan, then there is an additional requirement of having 2 years of property management experience before being approved.

Additional Financial Responsibilities Loans for a second home or rental property will usually have a higher interest rate in addition to the larger down payments. Business Listing Submission - Submission Summary. Conventional Mortgage Loan Tampa Bay Florida. Mortgage Loan Lender Tampa Bay Florida. Conventional Loan Lender in Tampa Bay.

A conventional mortgage is a loan for the purchase or refinance of a home that is not guaranteed or insured by the federal government (like a VA or FHA loan is).

A conventional mortgage is set according to limits determined by Freddie Mac and Fannie Mae guidelines. The loans are typically offered by banks, credit unions,and mortgage companies. Conventional mortgages are also available at a fixed or adjustable rate and available in 15, 20, or 30-year terms. Conventional Loan Qualifications: American Dream Home Mortgage Inc. Permanent loan lenders Tampa Bay, Florida. Construction / Permanent Loans. Conventional mortgage loans cannot be used to buy a plot of land to build upon, or to complete a semi-built home.

Many people attempt to take out a short-term loan for the purchase of the lot and the construction of the home, and then apply for a mortgage to pay off the short-term loan once the construction on the home is complete. Although this may work for some, many people run into the issue of not qualifying for the mortgage because their credit or income dropped after taking out a short-term loan. Construction-to-permanent loans are the solution to this issue. It is a type of mortgage loan option that allows the borrower to both finance the construction and purchase a new home, without having to re-qualify for a separate mortgage.

Advantages Disadvantages Inflexible rate optionsStrict timelines for constructionMay pay more in interest than a standard mortgageBuilding delays put loan at risk of cancellation How the Loan Works The Interest Rate on a Construction-to-Permanent Loan. American Dream Home Mortgage Inc. Mortgage Loan Lender Tampa, Florida. Real Estate Loan Lender Tampa, Florida. Moodle. Purchases or Refinance Mortgage Loan Lender Tampa, Florida. American Dream Home Mortgage provides several loan servicing options for all borrowers, whether they are purchasing a new home, second home, investment property, commercial real estate; or looking to refinance their current mortgage.

Some of the type of loans we issue for purchases or refinancing include: Conventional Loans: A home loan provided by a private lender such as a bank or mortgage company.FHA Loans: This program was put in place to help first-time homebuyers have a safe and secure loan that they could qualify for.VA Loans: VA loans are made by lenders and guaranteed by the U.S. Have inquiries about our Tampa Bay Area Purchases or Refinances Mortgage Loan? Contact our team today. USDA Home Loan Program. USDA Home Loan Lenders Florida. USDA Home Loan Lenders in Tampa, Florida. Finding a lender to purchase a manufactured home on a little piece of land doesn’t have to be difficult – we provide loans for them all of the time and can happily help you through the process.

There are several loan programs available that will finance a manufactured home, including: USDA LoansFHA LoansConventional Loans. American Dream Home Mortgage Inc - Brandon, FL. FHA Approved Loan Lender Brandon, Tampa Florida. FHA Loan Provider Brandon, Florida. FHA loan Lender in Tampa, Florida. FHA stands for Federal Housing Administration.

The FHA loan is backed by the federal government, which provides mortgage insurance on all loans made by any FHA approved lender. FHA loans are generally easier to qualify for than conventional loans. This program was put in place to help first-time home buyers have a safe and secure loan option that they could qualify for. FHA loan requirements: At least two years of steady employmentA minimum credit score of 580 or higher. FHA provides such low qualification standards that open the door for many home buyers that it makes you wonder if it is too good to be true; that there has to be a catch. Upfront Mortgage Insurance Premium (UFMIP) — This is the one-time, upfront payment required when using an FHA loan. American Dream Home Mortgage Inc - Best Cash Advances & Payday Loans in Brandon, FL.

Home Repair Loan Lender Tampa Bay. Home Improvement Loans, Florida. American Dream Home Mortgage. Most homeowners have a (long) list of repairs and changes that they would like to make to their home; update the kitchen, change the paint in the living room, repair the crooked cabinet, remodel the bathroom, build a deck, etc.

Sometimes the smaller items are able to be fixed fairly easily but the big changes, like remodels, updates, and additions are all put on hold until enough funds are served to get the job done. Sometimes the smaller items can be fixed fairly easily but the big changes, like remodels, updates, and additions are all put on hold until enough funds are saved to get the job done. Money stands between most homeowners and their American Dream of home improvements. Although expensive, that doesn’t have to stand in your way of completing your projects. There are numerous avenues available to current homeowners to help make repairs and renovations more affordable.

Several ways we can help you cross things off your honey-do list are through the following programs: Bill consolidation loan Lender Tampa, Florida. Debt Consolidation Loan Lender Tampa, Florida. Debt consolidation loan and Personal Loans Lenders in Tampa. Debt consolidation loans allow you to combine multiple unsecured debts into one bill. This can be especially helpful if you’re overwhelmed by several deadlines and interest rates.

These loans work by providing you the funds needed to pay off your multitude of other debts, leaving one bill (and only one interest rate) – the loan – to pay back. So, instead of having to make several separate payments to each creditor or collector every month, you make just one. This can help eliminate the chance for late payments, and could help you to reduce the amount of your payments that are spent battling interest charges, helping you pay off your debt faster. By combining all your bills into one rather than four or five payments, you may actually end up actually making a smaller monthly payment. What Types of Debts Can You Consolidate You can consolidate a variety of debts, including: Debt Consolidation Methods:

American Dream Home Mortgage Inc. Business Listing Submission - Submission Summary. First Time Home Buyer Tampa, Florida. Buying your own home is a common dream for many Americans that may feel, at times, just out of reach. One of the biggest hurdles is the upfront costs associated with buying a home, such as the down payment or closing costs. However, there are numerous loan options that are available that many first-time home buyers are able to qualify for, with little or no down payment. As for closing costs, there is no reason to fear this expense as many lenders will grant you a credit, or allow you to roll your closing costs into your mortgage (or you can negotiate with the seller to cover them costs for you). Loans With Little or Zero Down Payment Requirements FHA Loans: Highly beneficial for home buyers, including first time home buyers, with a poor credit history, low credit score, or who are unable to put an extensive down payment towards the loan. FHA Loan Lender Tampa, Florida.

First Time Home Buyer Tampa Bay, Florida. HARP Loan Lender in Tampa, Florida. HARP Refinancing Loan Lender in Tampa. HARP Refinancing LoanLender in Tampa, Florida. The Home Affordable Refinance Program (HARP®), is a federal program that was launched back in 2009. The program was recently extended, and is available through December 31, 2018. Refinancing when you have experienced a decline in the value of your home can be difficult with other refinancing loan options.

Choosing to refinance through HARP® can help you to obtain a more stable and affordable mortgage. It is designed to help homeowners who owe more on their mortgage than their home is worth (or have little to no equity in their home) to take advantage of lower mortgage rates and other refinance benefits. HARP® may help you obtain one or more of the following benefits of refinancing: A reduction in your mortgage rateA lower, more affordable monthly mortgage paymentChange to a fixed-rate mortgage from an adjustable-rate, interest-only, or balloon/reset mortgageA reduction in the term of your mortgage (e.g., from 30 years to 15 years) American Dream Home Mortgage Inc 1463 Oakfield Dr. Suite 127, Brandon, FL, 33511. Real Estate Property Loan Lenders in Tampa. Commercial Property Loan Lenders in Tampa, Florida. Commercial Real Estate Property Loan Lenders in Tampa, Florida. A commercial property or real estate loan is mortgage loan provided for a commercial property, rather than residential.

Financing commercial property can also include the costs for the acquisition, development, and construction of commercial real estate. How Commercial Loans Are Granted To qualify a business entity for a commercial real estate loan, lenders look at several factors: The loans collateral; the value of the commercial propertyThe creditworthiness of the business entityThe last 3 to 5 years of financial statements and tax returnsThe loan-to-value ratio of the propertyThe debt-service coverage ratio Commercial real estate loans provide a unique situation for lenders since a business entity may not have a financial track record or any credit rating. Although in a non-recourse loan, the lender does not require a guarantee by the owners (or principals) of the business entity to guarantee the loan. American Dream Home Mortgage Inc « USA Directory of Builders Home Improvement Professionals. USDA Loans Lender Florida. USDA Housing Loan Lender in Florida. American Dream Home Mortgage.

USDA Rural Loans are mortgages that are backed by the U.S. Department of Agriculture as part of its USDA Rural Development Guaranteed Housing Loan program. USDA loans offer 100% financing with reduced mortgage insurance premiums. If purchasing a property in an outlying area appeals to you, then the USDA loan may be the perfect fit to help you achieve your American Dream Home. With the no down payment option, it makes the financing process less expensive for you! Those currently that have a USDA loan are also able to refinance their current mortgage through this program. American Dream Home Mortgage Inc « USA Directory of Builders Home Improvement Professionals. First Time Home Buying Programs for Florida. American Dream Home Mortgage Inc - Realtors. Hard Money Loan Providers in Tampa. Florida Home Buying Programs. First Time Home Buyer Florida. Affordable Home Loan Lenders in Tampa. American Dream Home Mortgage. VA loans are provided by private lenders such as banks or mortgage companies and are guaranteed by the U.S.

Department of Veteran Affairs. VA loans are available to veterans, active service members, and qualifying surviving spouses for the purchase of a home. In most cases, no down payment is required on a VA loan. Sellers also have the option to contribute up to 4% of the purchase price towards the buyer’s closing costs, which may allow the veteran, active service members, or qualifying surviving spouse to purchase a home with little to no money needed at closing. Veterans, active service members, and qualifying surviving spouses can apply for a VA loan with any mortgage lender that participates in the VA home loan program.

VA Loan Lenders in Tampa. Affordable Home Loan Lenders in Tampa. American Dream Home Mortgage Inc Oakfield - Brandon, FL, United States - Financial Advisor. Bank Statement Loans Lenders for self employed in Tampa Florida. Bank Statement Loans Lenders in Tampa Florida. Bank Statement Mortgage loan Tampa. Bank Statement Loans Tampa. Tampa Bay Commercial Property Loans. Bill Consolidation Loans. Floridabestlending on Myspace. Best Mortgage Companies In Florida. Fha 203k Streamline Loan. Commercial Property Loan. Hard Money Lenders Tampa Florida. Which Loan is right for Your Home? Fha 203k Streamline Loan. Bank Statement Loans Florida. Mortgage Companies In Florida. Mortgage Calculator Florida. Mortgage Companies In Florida. Mortgage Calculator Florida. USDA Home Loan Program Highlights.