Fair FinCorp

Fair Fincorp is a finance company where we have created a milestone in providing the most authentic services to all our customers.

Managing A Credit Card on A Low Income. Everyone likes to buy the things they love and the temptation to buy them as soon as possible is the reason credit card exist and are used by many middles- and high-class people all over the world.

To match up with the latest trend people often couldn’t wait to save up the amount and would rather choose to pay that small amounts as EMI to have the product now. Money management during the Coronavirus Crisis. In the times of global connectivity and numerous trade routes, the world has become a single unified entity with having various individual elements helping each other for the greater good for everyone. when we talk about this great connectivity, we also talk about the global challenges we face together which could have many direct and indirect impacts over a long duration of time and could affect no matter who you are or wherever you are in today’s time.

Thus, you must realize the merits and demerits of such arrangements and be prepared with the best of your knowledge. Covid-19 (Coronavirus Crisis) has grasped the world in the shackles of lockdown for most of 2020 and while everyone is stuck inside their home and hoping for the betterment of the current state that we are in right now. New issues have started to arise which are born from the root cause of this global pandemic. We understand that the times ahead might be tough but now is not the time to panic. Stamp Duty and Registration at the time Of Property Purchase. Purchasing a property that can be a house, flat or just a piece of land is probably one of the biggest decisions you make in your life and it’s not just for you but the millions of families in the country which can be challenging both mentally and financially.

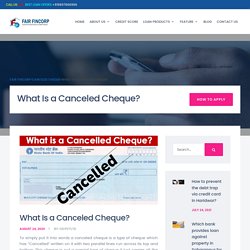

The decision we make has huge impacts on us and our future and thus is advised to make them with the best available knowledge beforehand. For most cases, people can pull off such high-value purchases with the help of a lender i.e. a bank through home loans. While there is a limit to the amount which can be borrowed, a person does prepare an estimated amount that might be required through this whole process and then arrange the amount with the loaned money and his/her savings. What Is a Canceled Cheque? To simply put it into words a canceled cheque is a type of cheque which has “Cancelled” written on it with two parallel lines run across its top and bottom.

This cheque is not a special type of cheque it just carries all the valid information that any other normal cheque would do is it will have your name, account number, IFSC code, MICR code, name of the bank, and the branch to which the cheque belongs. All this information is carried across all your cheques as you use it to write an order to the bank to provide you or someone else who has that cheque with the certain of money that is specified on the cheque. Thus, a cheque becomes a very useful entity that can be misused if not handled with proper care and that’s where a cancel cheque may come in handy as you can share all this personal information with anyone without worrying about the misuse of the check.

The uses of a canceled cheque certainly exceed what meets the eye and it’s not just a useless piece of paper. Personal loan consultant in india. Personal loan consultant in india. Record fall of India's GDP by 23.9% in April-June 2020. The promise of a 5 trillion economy by 2022 hit a major setback as the GDP of India hits its lowest number in decades.

Since the government started publishing growth rates in 1996 every quarter. With the new financial year (FY’21), the GDP of India in its first quarter saw these high dropping figures of 23.9% which showed the state of an already crumbling GDP with a 3.1% growth rate in the previous quarter. Thus, has become the talk of the nation regarding its economic future and its further implications. India has been in a state of lockdown since March of this year and amidst the COVID crisis. Where every major sector is facing a downfall by huge numbers, the economy was hit the worst felling to 26.9 lakh crore when talking in constant terms and the nominal GDP to 39.08 crores in comparison of last year a fall of 22.8%. Interestingly the sectors that were not directly associated with the implementation of lockdown. Personal Loan in Meerut. Are you thinking of that dream vacation?

Reinvent and fulfill all your dreams with a Personal Loan in Meerut. All major banks and NBFCs offer personal loans in Meerut including Punjab National Bank, IndusInd Bank, Kotak Mahindra Bank, SBI, Canara Bank, Axis Bank, Fullerton, Central Bank of India, HDFC Bank, ICICI Bank, IDBI Bank, Bajaj Finance, Shriram Finance, Citibank, etc. Quick Paperless Approval– In lieu of Covid-19, all the major banks and NBFCs are making sure that you have a minimum of touchpoints to prevent infection. Therefore, they’ve shifted to the digital mode of processing and approval. You literally don’t need to submit any physical document. Are you planning to follow a home loan? Here are 5 types of Home Loans in India. Record fall of India’s GDP by 23.9% in April-June 2020. The promise of a 5 trillion economy by 2022 hit a major setback as the GDP of India hits its lowest number in decades.

Since the government started publishing growth rates in 1996 every quarter. With the new financial year (FY’21), the GDP of India in its first quarter saw these high dropping figures of 23.9% which showed the state of an already crumbling GDP with a 3.1% growth rate in the previous quarter. Thus, has become the talk of the nation regarding its economic future and its further implications. How to prevent the debt trap via credit card in Haridwar?

If you are a borrower, you must know what the debt trap is.

In simple words, it is when the borrowers use credit cards in Haridwar more than they earn to repay their debts. And over time, the debt amount goes up, and the interest rate charged on the card goes up. Which bank provides loan against property in Saharanpur for senior citizens? Loan Against Property in Saharanpur. Finding the most appropriate bank to lend you money based on your credit score and personal financial information can be difficult.

When a senior citizen applies for a mortgage or a loan against property in Saharanpur, the lender will review their credit history and other factors to determine whether they can pay the amount borrowed. It means that your bank or lending company will consider things like your current income, employment history, debts, etc. Get Lowest ROI Possible - Fair Fincorp. Personal Loan Balance Transfer in Meerut offered by leading banks in India is becoming a trend among people suffering from debt problems due to the current economic slowdown.

If you have borrowed money from the bank to meet up some expenses or pay off debts in the past, it would be a good time to consider the options that these banks would provide you. You should try and find out if you would be given the same personal loan balance transfer in Meerut facility that you had obtained in the past. While you do this, you need to be aware of certain facts that would help you know whether the bank would allow you to have such a loan or not. Most of the banks in India have been giving personal loans to their existing customers for quite some time now. However, most of these people were not aware of these provisions, and therefore they did not know whether they could get such loans.

As you all know, most of the banks in India are working hard to earn the maximum amount of money. Get Lowest ROI Possible - Fair Fincorp. What is crucial: Your Credit Score or Your Credit Remark? Jatin is an IT business 30 years old. In six figures, his work rewards him. He’s wisely spending his money and pays in due course his taxes and expenses. He’s got a decent 790 credit score. His bid, however, was denied when he asked for a Car Loan. Fairfincorp in Delhi-NCR. Delhi is one of the prime locations, and buying a home here isn’t less than a dream come true. If you want to settle down here, buying a new home isn’t possible without a home loan. Get the best Home Loan in Delhi-NCR from HDFC, ICICI, CITI, FULLERTON, CITI, SBI, PNB, TATA CAPITAL, ADITYA BIRLA FINANCE, AVAAS, CANARA BANK, INDIAN BANK, BANK OF BARODA, BAJAJ, KOTAK & many more.

Quick Processing: All you need is basic details such as identity & address proof, income proof & documents of the property you wish to purchase. Most of the banks process the application the same day and get a pre-approval amount based on your profile & repayment capacity. Avoid these 5 Loan Scams this Year - Fair Fincorp. Do you get these texts & emails frequently? Pre-Approved Personal Loan of Rs up to 30 lacs. Apply Now! How to Deal with a Debt Trap? - Fair Fincorp. Are you also one of those stuck in a debt trap? Or Have you been riding the vicious cycle of debt but unable to get down?

Worry not! We’ve got your back. Here is some useful inside information that will help you come out of the vicious circle. Credit facilities such as credit cards, personal loans, home loans help you fulfill your needs and desires. Arpit works with a private firm & earns decent perks. But this couldn’t go too long as due for some reason; he again started using his credit cards. It’s one of the common scenarios of today’s generation. How to Deal with a Debt Trap? A personal loan is an unsecured short to medium-term loan without any collateral/securities for payment. They are generically paid out for little to no documentation in a matter of hours to a few days. The versatile end-use is an essential aspect of personal loans.

This unsecured loan will then be used for several uses, from medical costs to scheduled costs such as house reconstruction, weddings, etc. What is crucial: Your Credit Score or Your Credit Remark? 5 Ways to Get Rid of Your Diwali Debt. Avoid these 5 Loan Scams this Year. Top Home Loan Provider Company in Dehradun. How to safely run your construction business amidst COVID-19.

How to safely run your construction business amidst COVID-19 Covid-19 has turned out to be the biggest nightmare of the 21st century. How to Get the Most Suitable Personal Loan for You? How to Get the Most Suitable Personal Loan for You? How to Solve Issues with CIBIL? Shall I Apply For Personal Loan to Get My Dream Car Instead of Car Loan. Looking for a business loan consultant in Dehradun? How to safely run your construction business amidst COVID-19. Top Home Loan Provider Company in Dehradun. Business Loan for Startup Dehradun. We, at Fair Fincorp have earned the much deserved fame for providing some of the best services pertaining to attractive business loan. Things your Bank Doesn’t Want You to Know Before Home Loan Disbursal. Defaulted on loans/credit card, Forgot to opt for Moratorium. Now what? Defaulted on loans/credit card, Forgot to opt for Moratorium. How to Solve Issues with CIBIL? - Private Finance, PMAY Home Loan in Dehradun.

Why is my Loan Application rejected every time? Loan For Business in Dehradun. Insaurance — Loan Against Property in Dehradun. Loan Against Property in Dehradun. The Best Finance Company in Dehradun. Stamp Duty and Registration at the time Of Property Purchase. Loans That Can Give You Great Tax Benefits -Fair Fincorp. When A Borrower Fails to Repay the Loan! - Private Finance, PMAY Home Loan in Dehradun. Five Reasons Where You May Need an Emergency Personal Loan. How to Save Tax on Long-Term Capital Gains? - Private Finance, PMAY Home Loan in Dehradun. Managing A Credit Card on A Low Income - Private Finance, PMAY Home Loan in Dehradun. Money management during the Coronavirus Crisis.

Mistakes to Avoid when Taking Loan Against Property. THINGS TO REMEMBER BEFORE TRANSFER YOUR PERSONAL LOAN. WHY SHOULD YOU BUY A HOME BEFORE TURNING 30? Credit Card Consultants, Agents, Services, Companies, Providers. Guidelines to Avail Small Business Loan in Easy Way. Personal Loan Consultants From a Private Financier. Fair Fincrop’s Tips To Bring Down Your Home Loan EMI Derhadun. 5 Tips for Approved Your Personal Loan Dehradun India 2020. What You Need To Know About Loan Against Property Dehradun. Consultant Documents Need To Business Loan For Startup Dehradun? Consultant Documents Need To Business Loan For Startup Dehradun? How To Choose Right Home Loan Consultant Dehradun? Home Loan Balance Transfer in Dehradun.

Personal Loan in Dehradun - Apply online for Instant approval. Pradhan Mantri Awas Yojana Gramin List 2020 Dehradun. Car & Bike, Health & Home, Life Insurance Service in Dehradun. Problem loading page. Business Loan in Dehradun. Property Loan Consultant Dehradun. Home Loan Provider Company in Dehradun(UK) Private Finance, PMAY Home Loan in Dehradun.