What is StumbleUpon's business model? WordPress Plugin Developers Need Better Business Model. Plugin developers are the heart and soul of WordPress.

WordPress plugin developers not only extend the core functionality of WP but they drive innovation for the popular blogging platform. Compared to other blogging platforms, WordPress arguably possesses the strongest and most generous community of all. Despite this however, WP plugin developers receive very little compensation for their efforts to supply the WP plugin repository with quality free plugins.

Many developers reach a point at which they are simply unable to continue long-term support their plugins. This is largely due to the maintenance and support costs incurred for their plugins which far exceed the revenue generated by the donation based business model which most plugin developers utilize. Donations Alone Aren’t Sustainable WordPress has always pushed to make plugins and themes hosted at WordPress.org freely available under a General Public License (GPL).

Alternative Business Models For WP Plugin Developers1. 2. 3. Venture Voice: VV Show #21 - Fabrice Grinda of Zingy. « VV Show #20 - Joel Spolsky of Fog Creek Software | Main | VV Show #22 - Introducing the Venture Voice Entrepreneur of the Year Award » VV Show #21 - Fabrice Grinda of Zingy Download the MP3.

If you think the ringtone business is for kids, then Fabrice Grinda has a $130 million lesson to teach you. After starting the eBays of Europe and Latin America, Fabrice brought the ringtone business concept to America by starting Zingy. We caught up with Fabrice, now 31 and a millionaire several times over, just a couple of hours before he finished his last day at the helm of Zingy. Pirates of Silicon Valley trailer. Backbase iPad demo at FinovateSpring 2010. Corporate Venture Capital. Corporate venture capital (CVC), distinct from corporate venturing, is the investment of corporate funds directly in external start-up companies.

Corporate Venturing refers to when a company supports innovation and new projects internally.[1] CVC is defined by the Business Dictionary as the "practice where a large firm takes an equity stake in a small but innovative or specialist firm, to which it may also provide management and marketing expertise; the objective is to gain a specific competitive advantage.[2] The definition of CVC often becomes clearer by explaining what it is not.

Business - Exit Strategies for Your Business. Entrepreneurs live for the struggle of launching their businesses.

But one thing they often forget is that decisions made on day one can have huge implications down the road. You see, it's not enough to build a business worth a fortune; you have to make sure you have an exit strategy, a way to get the money back out. For those of you who like to plan ahead--and for those of you who don't but should--here are the five primary exit strategies available to most entrepreneurs: The Modified Nike Maneuver: Just Take It. One favorite exit strategy of some forward-thinking business owners is simply to bleed the company dry on a daily basis.

Le fonds des entrepreneurs internet - ABOUT US. ISAI is the French internet entrepreneurs’ fund.

Pledge fund. A pledge fund, in finance, is a private equity investment platform where unlike a traditional committed private equity fund, investors provide capital on a deal-by-deal basis.

In a pledge fund, the investors provide a loose commitment of capital to an investment team, the manager of the fund, to make investments within certain preset parameters. Thereafter, the investors must approve each transaction and will decide whether to pursue each transaction independently.[1] See also[edit] References[edit] Email Marketing and Email List Manager. About Dave McClure. [Short Bio] Dave McClure is a venture capitalist & founding partner at 500 Startups, an internet startup seed fund and incubator program in Mountain View, CA.

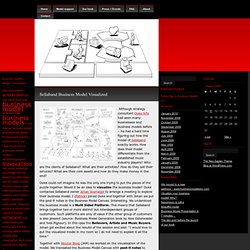

He likes to hang out with entrepreneurs, and occasionally invest in startups foolish enough to let him. He has been an investor in over 250 companies including Mint.com, Twilio, Wildfire Interactive, SendGrid, TaskRabbit, SlideShare, Mashery, CreditKarma, KISSmetrics, and MakerBot, among others. Dave has been geeking out in Silicon Valley for over twenty years, and has worked with companies such as PayPal, Founders Fund, Facebook, LinkedIn, Twilio, Mint.com, Simply Hired, O'Reilly Media, Intel, & Microsoft. Years ago he used to do real work like coding or marketing or running conferences, but these days he mostly does useless stuff like sending lots of email, blogging, and hanging out on Facebook and Twitter. Dave also likes to play ultimate frisbee when his knees don't hurt. [Not So Short Bio] [Community / Personal Interest] Sellaband Business Model Visualized « Business Models Inc. Although strategy consultant Ouke Arts had seen many businessess and business models before – he had a hard time figuring out how the model of Sellaband exactly works.

How does their model differentiate from the established music industry players? Nespresso is still a beautiful model « Business Models Inc. Talking about business models examples I believe Nespresso is one of the most popular case studies.

But why do we always use Nespresso as an example? Nespresso is sexy. Nespresso is hot. Nespresso is easy to understand. I often use Nespresso in our training courses and client strategy workshops. 1. 2.