Impact of REAL ESTATE CYCLE on Property Values. Having in mind how market capitalization rates move (see Chapter 1) 2 , and looking at the real estate cycle from the perspective of value increases , it appears that property values and sales prices get a double boost as the market moves from trough to peak. As the market improves, occupancy, rental income, and property income increase as well(see Figure 5). Increasing property income, in turn, exerts upward pressures on property values. Improved occupancy and rising rents reduce risk in the eyes of investors and reinforce expectations for continuing market improvements.

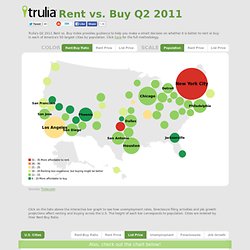

These perceptions exert downward pressures on market capitalization rates , which start to decrease, pushing values further up. Www.stoppayingrentamerica.com - Investment properties. House Buying/Building. Rent vs. Buy Index (Q2 2011) Click on the tabs above the interactive bar graph to see how unemployment rates, foreclosure filing activities and job growth projections affect renting and buying across the U.S.

The height of each bar corresponds to population. Cities are ordered by their Rent:Buy Ratio. Also, check out the chart below!