Crowdfunding. Funding - S&B. P2P Lending. Don Tapscott: Cutting Out the Banker Middleman. In the wake of the 2008 global financial crisis, we need to rethink and redesign many organizations and institutions that have previously served us well but are now beginning to falter.

Fortunately, the Internet lets us do this. It slashes collaboration costs and makes possible completely new models of combining people, skills, knowledge and capital for economic and social development. Around the world, individuals and groups are working together, developing new businesses based on peer-to-peer (P2P) collaborative networks. The financial services industry has always been the antithesis of P2P collaboration.

Hierarchy is deeply entrenched in this industry, for good reasons such as security, auditing, and regulatory compliance. First, financial services companies are moving beyond electronic mail, document management and other primitive technologies to new collaborative software suites like Jive and Moxie Software Spaces, which encourage P2P collaboration within corporate boundaries. Want a P2P Loan? See This Profile of a Typical Peer-to-Peer Borrower. You are here: Ask The Money Coach >> Want a P2P Loan?

See This Profile of a Typical Peer-to-Peer Borrower When you think about an individual who would borrow money from strangers, rather than fill out a loan application at a bank, what kind of image comes to mind? Do you think the borrower is desperate, has bad credit or has mismanaged his or her finances? Or maybe you think the person has few economic options, is lacking in financial sophistication or is willing to be economically exploited by the likes of loan sharks and unscrupulous payday lenders?

Well, if the borrower in question is someone seeking a peer-to-peer loan, chances are this borrower doesn’t fit the image you might think. Based on my interviews with the CEOs of two of the country’s largest peer to peer lending networks, Prosper and Lending Club, here is the profile of a typical P2P borrower, in terms of age demographics, credit characteristics and other factors. Age, Credit Rating and Financial Knowledge Related Questions: Peer-to-Peer Lending and Trust in the Netherlands. Master's Thesis: Peer-to-Peer Lending.

An empirical study of the requirements for a trusted online peer-to-peer lending platform in the Netherlands. By Syb Groeneveld. August 2011 URL = This paper was submitted in partial fulfillment of the requirements for the Master of Business Administration (MBA) degree at the Maastricht School of Management (MSM), Maastricht, the Netherlands, August 2011. Can citizen banking neuter the fat cats? - opinion - 12 December 2011. A LOT of people would like to do away with bankers right now.

But targeting individuals is not very helpful: most bankers were merely executing the plans of the institutions they worked for. How about ditching banks instead? Peer-to-peer lenders hope they can undermine banking in much the way that internet upstarts revolutionised the music business. But just as the buccaneering Napster found itself stymied by legal issues, so regulatory concerns have forced the citizen bankers to water down their radicalism (see "Bank says no? Ditch the bank – borrow from the crowd"). And while Napster might have started a revolution, it was left to the more emollient likes of iTunes to deliver it, using a mixture of techno-wizardry and commercial smarts. So what happens next? New Scientist Not just a website! More From New Scientist Déjà vu all over again for stem cell research (New Scientist) 'Tenth planet' is bigger than Pluto (New Scientist) Cute but deadly furball launches death attack (New Scientist)

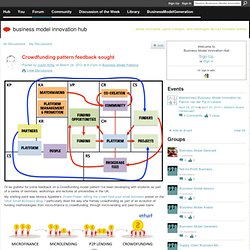

Zombie Banks Figure 2. Crowdfunding pattern feedback sought. I'd be grateful for some feedback on a Crowdfunding model pattern I've been developing with students as part of a series of seminars, workshops and lectures at universities in the UK.

My starting point was Monica Appelbe’s Crowd Power: letting the crowd fund your small business poster on the Intuit Small Business Blog. I particularly liked the way she frames crowdfunding as part of an evolution of funding methodologies from micro-finance to crowdfunding, through micro-lending and peer-to-peer loans: I also provide two patterns I've found that have used the Business Model Canvas template, so that a comparison of the Peer-to-Peer Lending model (e.g. Zopa.com) can be made with Micro-lending model (e.g. Kiva.org): Luftenegger, E., Angelov, S., van der Lindenz, E., & P.

Osterwalder, A. (2009). I had provided some analysis that had been made for each of the 9 building blocks, but sadly I lost the draft discussion on NING. . ▶ Reply to This. Funding_ideologies. P2P LENDING.