Decipher Credit

Decipher Credit is your one-stop-shop for all lending services.

What is Asset Based Finance Factoring And Is It Different From Loans? 22 Views When you are just getting started with a business and get a big order, it’s a great opportunity.

This order can help you to get exposure, establish your market, and get future business. However, all these benefits come with risks, and the biggest of them is a financial loss. You might have to take a huge amount as a loan for fulfilling the order, which opens you to risks. For instance, let’s say the client goes bankrupt or delays the payment; your business will have to deal with debt payments Factoring or, more precisely, asset based factoring can help you to prevent such unpleasant results. Choosing Right Digital Software For Banking Business. Knowing All About Asset Based Lending. Often people borrow money from any bank or other financial institutions which is termed as” loan” to meet your financial needs.

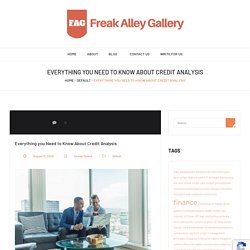

They may require money for various reasons such as education to buy a home and from buying vehicles to short term personal loans. Various banks and other financial institutions offer you loans from people apart from a financial instrument such as credit cards. Everything you Need to Know About Credit Analysis. If you are seeking debt for a commercial real estate project, you need to understand the basics of credit analysis.

It is a step in the credit approval process that evaluates the financial strength of the borrower. So, if you want to perform credit analysis on your own, here is a guide for you. Keep in mind that you also need to be aware of spreading financial statements. Banks use special tools for spreading financial statements, underwriting financial statements and other steps in the process.

Know The Underwriting Process For Taking Commercial Loans! Did you know that your finances go through an underwriting process before your loan?

Your loan can’t get to closing until your lender’s team completes the underwriting process for your mortgage. Bank and other lenders analyze the reasons for the requested borrowing along with your finances. This process is carried out by a commercial loan underwriter. The loan underwriter ensures that the borrower/borrower’s business has a reasonable potential to successfully repay the borrowed money. The lender or underwriter simply verifies your flow of income, assets, debt, and other property details to issue final approval to your loan request. What are the Different Types of Credit Risks. Posted by deciphercredit on July 23rd, 2020.

Get Your Identity Verified With The Government Through The KYC Process! Nowadays, each one of us is indulged in some or the other client-dealer relationships.

It is very crucial to have a firm proof of the identity of the person to prevent any fraudulent activity. "Know Your Customer" or KYC is a term used by businesses which refers to the process of verification of the identity of the customers and clients before or during the start of any business. Banks, e-commerce payment companies, or any financial institution are now required to get their customers' KYC process completed by the RBI.

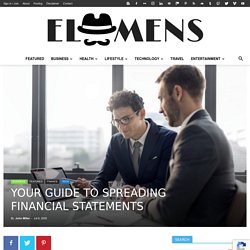

Effective KYC involves knowing a customer's identity, their financial activities, and the risk they may cause. KYC is done to prevent any illegal activities like bribery, money laundering, or corruption. YOUR GUIDE TO SPREADING FINANCIAL STATEMENTS. Spreading financial statements is a process through which a bank transfers information from a borrower’s financial statements and feeds it into the bank’s financial analysis spreadsheet program.

This is helpful for the bank as it can extract meaningful information from those statements. These reports may include financial ratios, common size balance sheet, common size income statement, cash flow, and reconciliation of net worth. Banks benchmark the financial sheets of similar kinds of companies, work out the ratios, and decide to give a loan after determining how much of the business can be liquidated if the need arises. 3 Reasons Your Business Needs Factoring Software Solution. How does the Loan Underwriting work? Every small-scale business person wishes to flourish in his arena which demands two major aspects: skills and capital.

Using Factoring Software and Disaster Recovery Plans. Everyone must understand the necessity of disaster recovery plans when it comes to data.

We know that data is the new oil, and you have to understand how important it is to back it up in critical situations. The first thing that comes to mind is software distribution and how it is kept safe in various places. There are many events in which an organization might need to reinstall applications. For continuity of operations, you need to keep your software intact with operational plans. Everything has to be protected, no matter how the organization deals with critical situations. Have a software inventory Software inventory means keeping the organization's software titles protected. Find a virtual space Creating a virtual space means creating extra opportunities for the software that is already installed.

Protect and organize software assets Create a folder that contains every type of file. Common Benefits of Cloud-Based Factoring Software. Cloud-based computing is becoming one of the most impactful technologies, which is transforming the way businesses are getting conducted so far.

This technology has successfully given the entire process of data collection, storage, and processing an exceptional makeover. Daily advancements into this technology provided us cloud-based factoring software, and the results from these have been power-packed so far. These cloud-based tools have leveled the ground for many small and medium-sized business organizations in this competitive ecosystem. In this article, we’re going to list down some benefits of using cloud-based factoring software, and we hope that by the end of it, you’ll be able to understand the untouched potential of this software.

Cost-effectiveness. The Ingredients of an Efficient Credit Union Operation : Decipher Credit. Understanding Peer-to-peer Commercial Lending and Its Benefits for Investors – We Consent. With evolving information and technology, financing models are also getting new makeovers. Gone are those days when conventional sources like banks and financing agencies had a monopoly in the market. Nowadays, new channels like hard money lending and peer-to-peer lending have started gaining massive popularity. Loan seekers look for the fastest modes of clearance that come with maximum possible options.

5 Influential Factors that Affect the Credit Underwriting Process.