Civil score check is the mantra to happy financial future – civilscores online. Credit score is the summarisation of a borrower’s financial habits and significantly influences the borrower’s financial life.

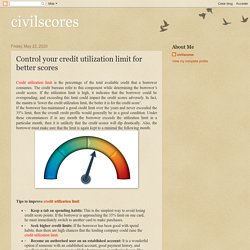

It is an essential component that gives an insight to potential lenders about a prospective borrower’s loan-eligibility and creditworthiness. As far as the borrower is concerned, the credit scores influence many financial transactions including mortgages, auto loans, credit cards, and private loans, and hence, a civil score check must be performed at least three-four times a year, if not monthly. These three-digit scores range from 300 to 900, and those between 750 and 900 are considered excellent by the lenders. Good scores are advantageous for both the lender as well as the borrower. The lenders take a look at the scores to know at how responsible the debt consumers are with their finances and whether they have a record of paying their bills on time. Tips to maintain good civil score Conclusion Like this: Like Loading... Civilscores: Control your credit utilization limit for better scores. Credit utilization limit is the percentage of the total available credit that a borrower consumes.

The credit bureaus refer to this component while determining the borrower’s credit scores. If the utilization limit is high, it indicates that the borrower could be overspending, and exceeding this limit could impact the credit scores adversely. In fact, the mantra is ‘lower the credit utilization limit, the better it is for the credit score’. If the borrower has maintained a good credit limit over the years and never exceeded the 35% limit, then the overall credit profile would generally be in a good condition. Under these circumstances if in any month the borrower exceeds the utilization limit in a particular month, then it is unlikely that the credit scores will dip drastically. A quick guide to PAN card civil check: civilscores — LiveJournal.

Remaining on top of your credit health is crucial for a good credit score.

Your scores are important as they are a reflection of your credit history and reveals how responsible you are with your finances. Though a lot has been said about credit reports, scores and how to keep it brimming, not much is known about the process to check cibil score by pan card. There are a lot of queries that a common man harbours, but they do not know where and how to get over them. Can you check cibil score by pan card? - civilscores - Medium. Wondering how your Permanent Account Number (PAN) could help you check your cibil scores?

We are here to get your answers on it. Stay armed with common civil buzzwords and full forms – civilscores online. The term Cibil is quite familiar now.

Bankers, lenders, financial advisers, etc., use the term fluently, but the jargons just sway past us. Rather, it could take us some time before realising what cibil full form stands for. If you have already ventured out and are trying to cope with the jargons being flung at you, this article is definitely for you. Secondly, if you contemplate visiting these financial personnel in their dens, it is a good idea to be armed with the vocabulary.

In both the cases, remaining updated empowers you and helps you understand your financial issues better. So, get accustomed and check out some of the commonly used jargons used bankers and other financial institutions. Run a civil check before applying for home loan: civilscores — LiveJournal. Are you looking for a home loan?

Take a deep breath before jumping into the loan market. There is a lot you need to do before finally applying for a home loan and running a cibil check to understand the quantum of amount you could negotiate upon. So, first let’s get cracking on getting our concepts clear. Learn more about cibil scores and their importance – civilscores online. A credit report or Credit Information Report (CIR) is a tool that helps the credit account holder gets a deeper insight into his financial status and options.

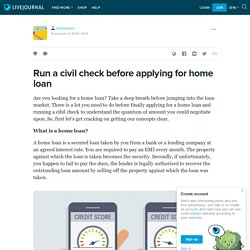

In India, a credit report is provided to individuals and credit ratings to businesses by India’s highest agency CIBIL. The agency releases the report based on the account holder’s past credit history which it receives from financial institutions across the country and eventually the individual is awarded a cibil score. The credit score of an individual is an indication for the lender whether the applicant or the prospective borrower is creditworthy. His credit history helps the lenders know whether you are a high-risk person. The score can be anything between 300 and 900.

What the RBI says about it? The Central Bank has made it mandatory for all credit bureaus across the country to offer one free detailed credit report per the calendar year to all its customers. Free Credit Score Online. Check civil score by pan card Ever wondered why applicant’s civil score is the first thing that the lenders look at while evaluating their loan or credit application?

Well, applicant’s credit report is an important tool to determine their creditworthiness and financial standing. Better the score, higher the chances of loan approval. But, what exactly this score is all about and how it plays a vital role in determining one’s financial health. So, before moving ahead, let’s get an understanding about the terms. Importance of cibil score calculation. Your credit score is a powerful tool to influence your financial life thoroughly, not just in present, but also in future.

Apart from determining interest rates, your score is also a key factor to decide credit card approvals. Moreover, insurance companies, too, have started to rely on applicant’s credit score in order to make an informed decision regarding the premiums and maturity returns. Hence, protecting and building a healthy credit score is more important than we ever thought. However, to withstand our commitments, it is first significant to understand the factors responsible for civil score calculation. Check free CIVIL score online whenever you like – civilscores online. A CIBIL score or your credit rating is an important factor that you take to meet your financial requirements.

Your credit information report plays a key role in a lender’s decision when you apply for credit. A civil score is generated by the bureaus after considering an individual’s detailed credit information. The Reserve Bank of India (RBI) has authorised credit bureaus operating in India to provide free full credit report (FFCR) once in a year without any charge to individuals who has a prior credit history. However, those wanting to check free CIBIL score online more than once are required to pay certain specified charges.

The charges specified include Rs 550 for monthly reports, Rs 800 for bi-annual and Rs 1,200 for each quarterly report. Civilscores: CIVIL Report – A summary of your financial standing. The Reserve Bank of India (RBI), in 2017, instructed all Credit Information Companies (CIC) or CIBIL Report generating companies to provide a free full credit report in digital/electronic form anytime during the calendar year. The report will be provided on request and due verification on the authenticity of the customer whose credit data is stored by the CIC. A CIBIL report generated for individuals is also known as a credit information report (CIR), while that generated for companies is called Company Credit Report (CCR) Though CIBIL empowers you to build your credit report, they aren’t so easy to understand.

It is a detailed and comprehensive document with details of secured/unsecured loans, overdraft facilities, credit cards, EMIs, etc. Decoding credit rating scale – civilscores online. Credit rating is an evaluation of a borrower – a corporate group or a company – that decides whether the borrower will be able to pay back the loan as per the loan agreement. Primarily, most rating agencies assign credit rating scale for seven categories. These include long-term, short-term, fixed deposit, dual ratings, structured obligations, credit enhancements, financial strength, and corporate credit ratings. The scales do not include credit quality ratings (CQR), small and medium enterprise (SME) ratings. The thumb rule is that any delay in payment of interest/principal of debt results in a revision of rating or the corresponding symbol if the rating is assigned on a different scale.

Credit ratings determine whether a borrower will be approved for a loan or debt issue and the interest rate at which the loan will be repaid. AAA- (Highest safety): This is the highest possible credit rating scale assigned to an issuer. Civil scores are your reputation: Protect them – civilscores online. A 27-year-old Mumbaikar was fortunate enough to save his civil scores from getting damaged after his ex-wife craftily availed bank consumer loans worth Rs 1.70 lakh and bought two expensive cell phones in his name. He was shocked to know that there was another account in his name from which Rs 73,900 was deducted and two cell phones worth Rs 48,000 and Rs 49,000 were purchased in his name. Well, this is not the lone incident of breach of identity.

Even social media platforms have admitted to sharing user data with advertising and third-party partners and many people have had their reputation at stake. Remember, civil scores are not mere numbers. They are a serious judgement about our character as human beings. Like this: Like Loading... Civilscores: Factors that punch your civil score. Are you new to the world of credits, civil scores and reports? Don’t worry, as this world of scores and reports and the constant effort to keep them clean can indeed be mind-boggling.

Civil scores are the first thing that any lender checks to approve your loan. Civil scores can be termed as a measuring meter that assesses your borrowing capacity and predicts if you are likely to default on your secured and unsecured trade lines. In other words, a healthy civil score helps you – the potential borrower – to identify the risk areas, manage them efficiently, minimise losses and increase profitability. Several slips could affect your scores, but before we get on to them, let’s understand why these 3-digit figures, ranging between 300 and 900, are crucial when applying for a loan. To build a good score it is vital to know the factors that affect it. User of Credit rating. Credit rating range: AAA, AA, A – Good BBB, BB – Average B, C, D – Low Credit rating agencies in India: ICRA Limited Originally named as Investment Information and Credit Rating Agency of India Limited, ICRA Limited was established in 1991 as an independent professional credit rating agency.

The agency offers detailed credit analysis ratings to different segments including Corporate Debt Rating, Financial Sector Rating, Corporate Governance Rating, Mutual Fund Rating, Project Finance Rating, etc. Check Civil Score Online. Check free civil(cibil) report online in India. Check Your CIBIL Score and Credit Score Online For Free.