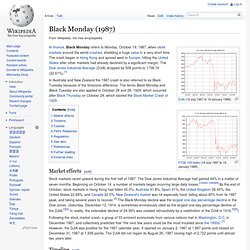

Bradley-cooper-3. Flashbacks of the 1970s for Stock-Market Vets. Market History in the 1980s. Black Monday (1987) DJIA (19 July 1987 to 19 January 1988).

In Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference. The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929. Stock markets raced upward during the first half of 1987.

The Dow Jones Industrial Average had gained 44% in a matter of seven months. Beginning on October 14, a number of markets began incurring large daily losses. Four Stars for Daniel. How the SEC Protects Investors, Maintains Market Integrity, and Facilitates Capital Formation (Securities and Exchange Commission) Introduction The mission of the U.S.

Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. As more and more first-time investors turn to the markets to help secure their futures, pay for homes, and send children to college, our investor protection mission is more compelling than ever. As our nation's securities exchanges mature into global for-profit competitors, there is even greater need for sound market regulation. Securities regulation in the United States. FINRA is a self-regulatory organization that promulgates rules that govern brokers and dealers and certain other kinds of professionals in the securities industry.

It was formed by the merger of the enforcement divisions of the National Association of Securities Dealers (NASD) and the New York Stock Exchange. FINRA, like the exchanges and the SIPC, is overseen by the SEC, and FINRA's rules are generally subject to SEC approval. All brokers and dealers that are registered with the SEC (pursuant to 15 U.S.C. § 78o), with a number of exceptions, are required to be members of SIPO (pursuant to 15 U.S.C. § 78ccc), another self-regulatory organization, and are subject to its regulations. Securities fraud. Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information, frequently resulting in losses, in violation of securities laws.[1] Offers of risky investment opportunities to unsophisticated investors who are unable to evaluate risk adequately and cannot afford loss of capital is a central problem.[2][3] Securities fraud can also include outright theft from investors (embezzlement by stockbrokers), stock manipulation, misstatements on a public company's financial reports, and lying to corporate auditors.

What is Trading Securities? New York Shopping and New York Stores. The fashion capital of the world can't help but be the shopping capital as well! Our New York City shopping guide features expert reviews and recommendations for all sorts of New York stores, from fashion-forward boutiques to retro consignment and vintage stores. We've even put together comprehensive guides to New York's top shopping districts like SoHo and Nolita! The Hamptons Travel Guide - Hotels, Restaurants, Sightseeing in The Hamptons - New York Times Travel. The Hamptons. The Hamptons, highlighted (center) on South Fork of Long Island, an island 118 miles (190 km) long. West to east[edit] Family_estate_hamptons3. Hamptons Houses. East Hampton (town), New York. Manhattan Sightseeing Map, New York City. Greenwich Village > nyc neighborhood profiles. Fifth Avenue. Coordinates: The American Planning Association (APA) is a distinguished organization devoted to supporting practicing planners, citizens, and elected officials who are dedicated to making great communities flourish.

APA compiled a list of “2012 Great Places in America” and declared Fifth Avenue to be one of the greatest streets to visit in America. This historic street is home to extraordinary museums, businesses and stores, parks, luxury apartments, and historical landmarks that are reminiscent of its history and vision for the future.[4] Fifth Avenue originates at Washington Square Park in Greenwich Village and runs northwards through the heart of Midtown, along the eastern side of Central Park, where it forms the boundary of the Upper East Side and through Harlem, where it terminates at the Harlem River at 142nd Street. Traffic crosses the river on the Madison Avenue Bridge. History[edit] Historical landmarks[edit] New York City Landmarks Preservation Commission[edit] Parade route[edit] Manhattan. New York City Manhattan Neighborhood Map. Morgan Stanley. Morgan Stanley (NYSE: MS) is an American multinational financial services corporation headquartered in the Morgan Stanley Building, Midtown Manhattan, New York City.[5] Morgan Stanley operates in 42 countries and has more than 1300 offices and 60,000 employees.[6] The company reports US$1.9 trillion in client assets under management as of the end of 2013.[4] The corporation, formed by J.P.

Morgan & Co. partners Henry S. Morgan (grandson of J.P. Wachovia. Wachovia (former NYSE ticker symbol WB) was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. Lehman Brothers Holdings Inc. News. Lehman Brothers. Three Lessons of the Lehman Brothers Collapse. A year ago today, the venerable investment-banking firm Lehman Brothers filed for bankruptcy protection after the Federal Reserve and the Treasury Department pointedly refused to bail the company out, and no other Wall Street outfit was willing to step into the breach.

It was the largest bankruptcy ever in the U.S., but the really big news was what happened afterward. First came a financial panic that threatened to shatter the global capitalist order, then came an unprecedented, and unprecedentedly expensive, effort by governments on both sides of the Atlantic to patch things up. You already knew all this, of course. American International Group. American International Group, Inc. – also known as AIG – is an American multinational insurance corporation with over 63,000 employees globally.

American International Group, Inc. - Corporate Information. The crisis: A timeline - The events that broke Wall Street (1) - CNNMoney.com. United States housing bubble. The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states.

Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012.[2] On December 30, 2008 the Case-Shiller home price index reported its largest price drop in its history.[3] The credit crisis resulting from the bursting of the housing bubble is — according to general consensus — the primary cause of the 2007–2009 recession in the United States.[4] Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets.[5] In October 2007, the U.S.

Secretary of the Treasury called the bursting housing bubble "the most significant risk to our economy. "[6] Any collapse of the U.S. Background[edit] Housing bubbles may occur in local or global real estate markets. John A. 25 Awesome Infographics to Visualize the Housing Crisis. One of the reasons that we are having such a problem in our economy is due to the crash of the housing market.

Indeed, the housing market crash that some say began in 2007 and accelerated through 2008 (with the financial crisis of 2008 helping out). Those involved in construction management know first hand the issues that have plagued the housing market since the crash. With home prices still quite low, there are some immediate worries.