The US 2012 Once-in-a-Century Election: US-China Cooperation or Global Trade Wars? The U.S. 2012 election will also pave way to the most complicated international power transition in the past 140 years as the rising China may replace the United States as the leading growth engine of the world economy by 2020.

US presidential elections of 2012 will take place in the most challenging environment, which will not be immune to catastrophic crises. In the coming months, the US economy will be close to or in recession territory. Due to the Eurozone crisis, risks are heavily tilted to the downside. Meanwhile, large emerging economies, spearheaded by China and other BRIC nations as well as the surging Asia, are driving global growth. To make things even more complicated, the US presidential election will coincide with China’s 18th Party Congress in 2012, when current Vice President Xi Jinping will succeed President Hu Jintao, and Vice Premier Li Keqiang is expected to replace Premier Wen Jiabao. Once-In-A-Century Transition During President Obama’s first term, the broadened U.S. More On China And Jobs. Rob Johnson of INET sends me to an interesting paper by Autor, Dorn and Hanson (pdf) that uses regional data to estimate the impact of China imports on manufacturing employment.

The idea is to exploit the major differences among US metro areas in industrial specialization: some areas produce a mix of goods that is in effect in China’s path, while others don’t. The results suggest, as I have been arguing, that it’s wrong to dismiss Chinese exports as not really being in competition with US production. Who Will Eclipse America? - Simon Johnson. Exit from comment view mode.

Click to hide this space WASHINGTON, DC – According to Voltaire, the Roman Empire fell “because all things fall.” It is hard to argue with this as a general statement about decline: nothing lasts forever. China, U.S. could tangle over Mideast oil. China Is Not America's Banker, RealClearWorld - The Compass Blog. Nathan Gardels: Kissinger: G-20 Is the Key Forum for Adjusting Global Power Shift. News and views on emerging markets from the Financial Times. Guest post: don’t discount risks of trade protectionism By William R.

Rhodes, William R Rhodes Global Advisors Political and economic conditions are evolving in ways that could promote the onset of a new era of global protectionism. China and Russia Are Snubbing American Chicken. For years, the U.S. chicken industry has boosted profits by selling white meat to Americans, who eschew darker cuts, and exporting tons of thighs, legs, and feet to China, Russia, and Mexico, where consumers are less fussy.

That equation is now changing as China and Russia reduce imports and increase their domestic supplies, leaving dark meat piling up in the U.S. Compounding the pain for producers such as Tyson Foods (TSN), Sanderson Farms (SAFM), and Pilgrim’s Pride (PPC), feed costs are rising and bird prices have fallen. With production increasing as the big players jockey for position, investment bank Stephens says processors are losing an average of 12¢ on every pound they produce this year.

Read China’s Lips - Stephen S. Roach. Exit from comment view mode.

Click to hide this space NEW HAVEN – The Chinese have long admired America’s economic dynamism. But they have lost confidence in America’s government and its dysfunctional economic stewardship. That message came through loud and clear in my recent travels to Beijing, Shanghai, Chongqing, and Hong Kong. Four Reasons China is Betting On Europe (And Will Lose) Slip-Up in Chinese Military TV Show Reveals More Than Intended. By Matthew Robertson & Helena ZhuEpoch Times Staff Created: August 21, 2011 Last Updated: April 7, 2012 EXPOSED: A picture of the hacking software shown during the Chinese military program.

The large writing at the top says 'Select Attack Target.' Next, the user choose an IP address to attack from (it belongs to an American university). The drop-down box is a list of Falun Gong websites, while the button on the left says 'Attack.' (CCTV) Updated August 28, 8:50am EDT A standard, even boring, piece of Chinese military propaganda screened in mid-July included what must have been an unintended but nevertheless damaging revelation: shots from a computer screen showing a Chinese military university is engaged in cyberwarfare against entities in the United States. U.S. War with China “Inevitable,” Author Glain Says. Outside of the market madness, the biggest global news this week might be China sending its first aircraft carrier to sea.

The launch was not unexpected and China sought to downplay its significance, saying "it will not pose a threat to other countries. " A U.S. Sovereign Credit Downgrade Is No Laughing Matter. By EconMatters With a stalemate heading into the weekend, the debt drama of the United States is going down to the wire, and when the clock strikes twelve midnight on August 2 (countdown clock at our homepage), the world's largest economy could be looking at an unprecedented technical default.

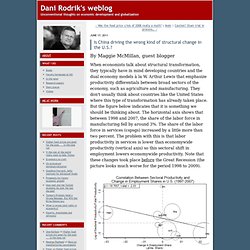

The current consensus suggests that although a total default is nothing but a remote possibility, the damage is already done to the dollar, and a sovereign debt downgrade could be inevitable even after the debt ceiling deadlock is resolved. China, as the largest foreign holder of the U.S. debt, is totally freaking out. as NPR reported, "State Department officials now admit that China has been using diplomatic channels to express its concern. Welcome to Center for America-China Partnership ! Is China driving the wrong kind of structural change in the U.S.? By Maggie McMillan, guest blogger When economists talk about structural transformation, they typically have in mind developing countries and the dual economy models à la W.

Arthur Lewis that emphasize productivity differentials between broad sectors of the economy, such as agriculture and manufacturing. They don't usually think about countries like the United States where this type of transformation has already taken place.