Whatever The Outcome Of The Debt Vote, The Age Of Austerity Is Here. Whatever the outcome of Thursday's projected House vote on Speaker Boehner's debt plan, this process has already ended the political life of one prominent member of the Washington establishment: John Maynard Keynes.

True, Keynes died in 1946. But his ghost hovered over America's economic debate until pretty much Monday night. At that time, in their ostensibly dueling speeches, both President Obama and House Speaker Boehner embraced the language of "austerity" and performed an unwitting exorcism. In brief, Keynes is the man whose ideas led to 2009's stimulus policy.

Will the divergence in growth result in eventual convergence in incomes? I showed a neat picture in my previous post on the divergence in growth rates between developing and rich countries.

But can developing countries really carry the world economy? Much of the optimism about their economic prospects is the result of extrapolation. The decade preceding the global financial crisis was a unique period, characterized by a lot of economic tailwind. Commodity prices were high, benefiting African and Latin American countries in particular, and external finance was plentiful and cheap. Moreover, many African countries hit bottom and rebounded from long periods of civil war and economic decline. Optimists are confident that this time is different. But igniting and sustaining rapid growth requires something more: production-oriented policies that stimulate ongoing structural change and foster employment in new economic activities.

If history is any guide, the range of countries that can pull this off will remain narrow. Read the full column here. The Great Divergence, the Other Way Around" The Future of Economic Growth - Dani Rodrik. Exit from comment view mode.

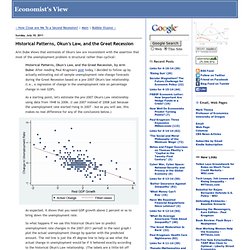

Click to hide this space CAMBRIDGE – Perhaps for the first time in modern history, the future of the global economy lies in the hands of poor countries. The United States and Europe struggle on as wounded giants, casualties of their financial excesses and political paralysis. They seem condemned by their heavy debt burdens to years of stagnation or slow growth, widening inequality, and possible social strife. Historical Patterns, Okun's Law, and the Great Recession. Arin Dube shows that estimates of Okun's law are inconsistent with the assertion that most of the unemployment problem is structural rather than cyclical: Historical Patterns, Okun's Law, and the Great Recession, by Arin Dube: After reading Paul Krugman's post today, I decided to follow up by actually estimating out-of-sample unemployment rate change forecasts during the Great Recession based on a pre-2007 Okun's law relationship (i.e., a regression of change in the unemployment rate on percentage change in real GDP).

As a starting point, let's estimate the pre-2007 Okun's Law relationship using data from 1948 to 2006. (I use 2007 instead of 2008 just because the unemployment rate started rising in 2007 - but as you will see, this makes no real difference for any of the conclusions below.) As expected, it shows that you need GDP growth above 2 percent or so to bring down the unemployment rate. Several things jump out: 1. 2. 3. 4. Data Source: The two data series are UNRATE and GDPC1.

Degrowth in a context of infinite growth. Prosperity without Growth? - The transition to a sustainable economy · Sustainable Development Commission. Our economy is geared, above all, to achieving growth.

In times of recession especially, economic policy is all about returning to growth. But a financial crisis can also be an opportunity for some basic rethinking about what the economy is for, and how through some fundamental restructuring of our financial system we can safeguard our economic stability in the future, as well as achieving wider social and environmental benefits. In recent years, other objectives such as sustainability and wellbeing have moved up the political agenda. Over two years, the SDC's Redefining Prosperity project looked into the connections and conflicts between sustainability, wellbeing and growth. Following a series of seminars and commissioned thinkpieces, we published the report Prosperity without Growth? Reportage - The crisis of middle-class America. Technically speaking, Mark Freeman should count himself among the luckiest people on the planet.

The 52-year-old lives with his family on a tree-lined street in his own home in the heart of the wealthiest country in the world. When he is hungry, he eats. When it gets hot, he turns on the air-conditioning. When he wants to look something up, he surfs the internet. One of the songs he likes to sing when he hosts a weekly karaoke evening is Johnny Cash’s “Man in Black”. Yet somehow things don’t feel so good any more.

What is most troubling about the Freemans is how typical they are. <div class="storyvideonojs"><div><p>You need JavaScript active on your browser in order to see this video. Once upon a time this was called the American Dream. Mention middle-class America and most foreigners envision something timeless and manicured, from The Brady Bunch, say, or Desperate Housewives in which teenagers drive to school in sports cars and the girls are always cheerleading.