How To Invest: The Best Stocks Form Bases Before Breaking Out To New Highs. If you've read Investor's Corner for the past eight or nine days, you've placed into your hands a real map to find stock-market treasure.

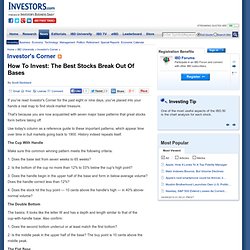

That's because you are now acquainted with seven major base patterns that great stocks form before taking off. Use today's column as a reference guide to these important patterns, which appear time over time in bull markets going back to 1900. How To Trade: Be Patient With Saucer Patterns For They Wear Out, Not Shake Out, Investors. The cup without handle and cup with handle are some of the most common chart patterns.

They have a less commonly seen cousin: the saucer base, which can also lead to large gains. Saucers are usually more stretched out and flatter than a typical cup-type base. As the name suggests, they resemble the silhouette of shallow dishes or saucers. While some chart patterns scare investors out with fast, sharp corrections, saucers have the distinction of wearing investors out. So if you see a potential saucer forming, patience can be a virtue. After a prior uptrend of at least 20% or 30%, a stock will slowly drift lower, then trade almost sideways before finally forming the right side of the base.

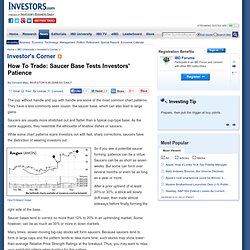

Saucer bases tend to correct no more than 12% to 20% in an uptrending market. Many times, slower-moving big-cap stocks will form saucers. How To Trade: Spot Stock Chart Patterns Among Market Winners Such As The Square Box. If you think about a base as a stock catching its breath, then the quickest breather comes when an issue etches a square-box pattern.

The square box just takes four weeks to develop and does not exceed seven weeks. Other types of bases require a minimum five, six or seven weeks. The square box, a relatively new pattern among the lineup of bases defined by IBD, not only forms quickly but is generally a shallow structure. With a square box, a stock corrects no more than 15%. William O'Neil, IBD's founder and chairman, first explained the pattern in the fourth edition of his book "How to Make Money in Stocks" in 2009. Deere & Co. The farm equipment giant motored past a 79.76 buy point in early December 2010, and then ended up advancing as much as 25% through early April of this year. The entry point comes from a square box that began to take shape in early November 2010. How To Invest: An Ascending Base Says Buy When Bargain Hunters Are Most Afraid Of A Stock. The ascending base is challenging.

Because the base involves three pullbacks and three advances — each making a higher high and a higher low — it can be difficult to spot. The flat base, the saucer and the cup involve only one general pullback as they sketch the left side of a base. How To Trade: Why Care About Base Patterns? Great Stock Winners Form Them All The Time. History repeats itself.

That's why you took the time in recent columns to learn about key base patterns that dominate stock-market history. Don't look so surprised. After all, these bases reflect human activity which, in turn, is largely directed by emotions. How To Invest: A Base-On-Base Offers A Second Chance To Produce A Big Run. Desperate times often call for patience.

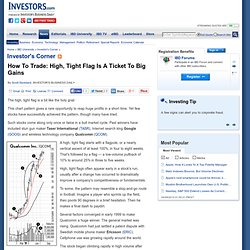

Leading stocks fighting to break out against a pitch-and-buckle market might take a little bit longer to set themselves up for glory. One chart intricacy that often results is the base-on-base pattern. It often forms when a breakout succumbs to market pressure before posting a 20% gain. The stock falls into another consolidation, giving up some, if not all, of its gains. To many investors, the move looks like an unqualified failure. How To Trade: Catching A High, Tight Flag Could Lead To Fast Riches. The high, tight flag is a bit like the holy grail.

This chart pattern gives a rare opportunity to reap huge profits in a short time. Yet few stocks have successfully achieved the pattern, though many have tried. Such stocks come along only once or twice in a bull market cycle. Past winners have included stun gun maker Taser International (TASR), Internet search king Google (GOOG) and wireless technology company Qualcomm (QCOM). How To Trade: Tight Sideways Price Action May Turn Into A Bullish,Flat-Base Stock Pattern. When a stock starts trading sideways, don't take it off your watch list.

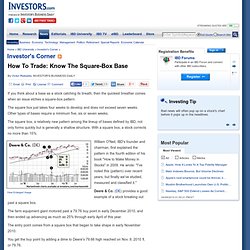

How To Invest: Winning Stocks Often Catch Their Breath With A Double-Bottom Base. Winning stocks usually catch their breath at some point.

When they do that, their stock charts show a period of price consolidation, or what IBD often calls a "base taking shape. " The most common types of bases are the cup pattern, the cup-with-handle structure, the flat base and the double bottom. This column will look at the double bottom, focusing on the one that Rackspace Hosting (RAX) etched from late December 2009 through early September 2010. A double bottom looks like the letter W.

Generally, the second bottom should undercut the first bottom. The buy point comes from the middle peak in that W-like structure. Other points to keep in mind: This pattern doesn't occur as frequently as the cup with handle, but it still occurs often. How To Invest: Learn Details Of A Well-Formed Cup-With—Handle Base In Great Stocks. The cup-with-handle pattern is perhaps the most common and most recognizable of all the bases.

The biggest peril is not in missing one, but in jumping onto one without checking under the hood. How To Invest: Long Bases Shouldn't Be Ignored When Looking For Great Stocks To Buy. When flipping through stock charts, an investor should look with a wide-angle lens.