4 Easy Tips to Prevent Recency Bias. How To Combat Trading Analysis Paralysis. It happens to the best of us; that moment when, despite knowing that the time is right, that your chart makes this a perfect trade, that you’ve got the money and could lose it if you needed to (even though you probably won’t), you just don’t make the trade.

You’ve got trading analysis paralysis. So how to combat trading paralysis? There are some tried and true methods to get you back on track. The Euro-Dollar's Most Important 24 Hours This Year. While foreign exchange markets are gearing up for the all important Federal Open Market Committee meeting on December 16, implied volatilities in euro-dollar show that key events prior to that may prove even more important, Bloomberg strategist Vassilis Karamanis writes.

On December 3, the European Central Bank may announce further monetary stimulus. That same day, Fed Chair Janet Yellen testifies before the Joint Economic Committee of the U.S. Congress. A day later, the next U.S. employment report is due. These events may just help the market determine the common currency's price action versus the dollar going into year-end and further out. Divergence, Linear Thinking and the Dollar. December will be a month to remember.

ECB President Draghi continued to fan expectations of further accommodative measures at the December 3 meeting. Mind the Gap as Currency Markets Shrivel for All But Biggest Few. Even the world’s biggest financial market can’t escape the global liquidity drought.

Currency traders accustomed to shifting billions of dollars around the globe are starting to suffer as dealers retrench. Investors facing higher costs in this environment could rein them in with strategies that include splitting trades into several tranches, timing transactions to match peak turnover and avoiding a change of position too close to big events, according to money managers at Pioneer Investments and Macro Currency Group.

We’re not talking about emerging markets here. Mind the Gap as Currency Markets Shrivel for All But Biggest Few. Fxstreet. The best way to trade currencies into year-end is to ride the monetary divergence wave.

The latest U.S. jobs number satisfies the Fed's preconditions for raising interest rates and the strong prospect of tightening next month should extend the greenback's gains over the next few weeks. Buying dollars after a strong move can be difficult for many but when a trend is driven by major fundamental news that the market may not had fully anticipated, the adjustment in expectations can lead to a fast, aggressive and big move in currencies. The Big Lesson of the Eurozone Crisis. Paul Krugman notes that Eurozone crisis is a vindication of that optimum currency area (OCA) theory.

I agree but would note the crisis also sheds light on the specialization versus endogeneity debate surrounding the OCA criteria. Interestingly, Krugman himself wrote some of the literature in this debate back in the early-to-mid 1990s. The dark clouds of peace. Euro’s Resilience During Greece Debt Crisis Belies Damage Done. The euro may have avoided the indignity of losing a member, yet the wrangling over Greece has delivered lasting damage to its image in the eyes of investors.

Millennium Global Investments Ltd. and M&G Investments Inc., which manage a combined $413 billion, say the political brinkmanship leading up to last week’s bailout deal exposed the euro zone’s weakness: the lack of a fiscal union. Commerzbank AG, Germany’s No. 2 lender, warns the ongoing crisis will erode demand for the euro as a reserve currency, which reached a 13-year low in March. “There are cracks in the edifice of the currency union,” said Richard Benson, a money manager at Millennium Global in London, which oversees $13.4 billion in foreign-exchange assets. Why do Many Forex Traders Lose Money? Here is the Number 1 Mistake. We look through 43 million real trades to measure trader performanceMajority of trades are successful and yet traders are losingHere is what we believe to be the number one mistake FX traders make Why do major currency moves bring increased trader losses?

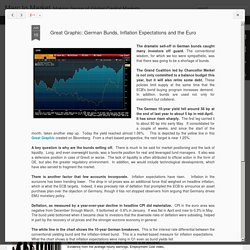

To find out, the DailyFX research team has looked through over 40 million real trades placed via parent company FXCM’s trading platforms. German Bunds, Inflation Expectations and the Euro. The dramatic sell-off in German bunds caught many investors off guard.

The conventional wisdom, for which we too were sympathetic, was that there was going to be a shortage of bunds. The Grand Coalition led by Chancellor Merkel is not only committed to a balance budget this year, but it will also retire some debt. The euro’s relationship with the bund has hit the rocks. Reuters The euro has been taking its cues from the 10-year bund yield since its decline against the dollar began accelerating last summer.

But over the past month or so, the correlation has begun to unravel, and this unraveling has grown more pronounced in recent weeks. The shift away from this correlation has puzzled currency strategists. Higher sovereign bond yields typically attract foreign investors into a currency because they lead to higher returns. How the carry trade could explain EUR/USD’s counterintuitive moves. Traders all over the world over have been surprised by the relative resilience of the euro over the last few weeks, despite growing concerns that Greece may default on its debt and be forced to exit the Eurozone (the feared “Grexit”). Analysts have proffered various explanations for the EUR/USD’s durability: that the European financial system has had plenty of time to “ring fence” Greece and prevent contagion to other countries, that a last-second deal is imminent, or even that traders are just blithely underestimating the risk and damage of a Grexit.

One alternative explanation that we find particularly compelling is “Euro as a Funding Currency Theory.” As a reminder, the carry trade is when a trader borrows in (sells) a low-yielding currency and invests in (buys) a higher-yielding currency in an attempt to profit from the difference in interest rates. However, as all experienced traders know, every strategy comes with risks and the carry trade is no exception.

The Heretic's Guide to Global Finance: Hacking the Future of Money: Algorithmic surrealism: A slow-motion guide to high-frequency trading. I say 'perhaps', because it really depends on how long you pause on those commas I put in the sentence. If you’re an individual with great respect for commas you might give the algorithm a chance to throw in a few hundred more orders. Let’s just clarify this. That means computers owned (or leased) by a firm somewhere can 1) suck in data from a stock exchange, 2) process it through a coded step-by-step rule system (algorithm) to make a decision about whether to trade or not, 3) send a message back to the exchange with an order for shares of ownership in a company – for example, a company that makes children’s toys – 4) get the order executed and confirmed, and 5) repeat this maybe 250 times a second.

Well, it could be more or less than that, too, and to be honest, few people seem to actually know how fast these algorithmic engines trade. High-Frequency Trading around Large Institutional Orders · Albert J. Menkveld. Jun 18, 2015 When high-frequency traders (HFTs) enter markets, the bid-ask spread declines. Several academic studies have reported such result.

Investors pay less for each market order they send. USD's New Path of Least Resistance. The plot thickens for USD bulls as the US currency falls victim to a deepening in the dynamics, which had previously capped its advances, namely faster gains in German yields relative to the US, prolonged erosion in Germany's DAX and the resulting close of euro hedges and lack of continuity in Fed tightening its planned rate lift-off (assuming one will take place this year). Last week we mentioned the German-US 10year yield spread broke hit 4-month highs. Who Is Responsible For This Volatility? - Deutsche Bank. 2015 will go down as the year when all of the Fed, ECB, BOJ and SNB hit an inflection point in their willingness to distort and manipulate markets, notes Deutsche Bank. Why The USD Failed To Capitalize On Strong US Data? - Morgan Stanley.

The Alleged Flash-Trading Mastermind Lived With His Parents and Couldn’t Drive. EUR/USD: Whats driving the extreme volatility? This comes via eFX. Bunds And Euro Tied At The Hip? Jun. 3, 2015. Psychology more Important than Data in the Week Ahead. What Happened to Euro-Dollar Parity? Euro’s Surge Tramples Parity Predictions. Euro Wreaks Havoc on Carry Trades in Rally Almost No One Foresaw. It was supposed to be so easy. Borrow in euros as the European Central Bank kept interest rates near zero and use the proceeds to invest in the economies where rates are higher, pocketing the difference and generating huge profits.

For a while it worked -- that was, until about a month ago when global markets began to go haywire and the euro, instead of weakening as most every strategist surveyed by Bloomberg predicted, began to rally. Investors who embraced the carry strategy have seen losses of 3.5 percent since the end of March, according to a UBS Group AG index. EURUSD to Break a 50 Year Average, part 1. EURUSD to Break a 50 Year Average, part 2. GDP for the Eurozone before the crisis and since Euro inception remained positive and healthy as it ranged above 0 to 1.5 but since the crisis, GDP has remained depressed. Further, credit growth for March 2015 to residents was 0.4%, 0 previous and negative 0.2% annualized yet negative 0.5 February. The growth rate of short term deposits other than overnight deposits was negative 3.3% March 2015, negative 3.2% February.

The Dollar Joins the Currency Wars by Nouriel Roubini. NEW YORK – In a world of weak domestic demand in many advanced economies and emerging markets, policymakers have been tempted to boost economic growth and employment by going for export led-growth. Euro And Bund: 1 Trade. Marc Chandler. 3 Reasons for the Euros Mind Boggling Rally - Trading Forum and Blogs. World Faces New Collapse Under Strong Dollar: “We’re Going to Have Another Financial Crisis" Hacker news. Discussion: a web reading bot made millions on the options market.

Bot makes $2.4 million reading the Web: Meet the guy it cost a fortune. A web-reading bot made millions on the options market. The Euro: Its Beginning, Its End, and Its Future. Bank of Russia hosts meeting on Forex law. Citi seeking to sell retail FX arm: source. Fast forex moves raise liquidity worries - FT.com. EUR: Record short position build further - TDS. Light volume doesn’t skew currency rates on Good Friday. The Algo Rampage Begins. Jack Lew: China's currency is not ready for prime time - Apr. 1, 2015. Stronger Dollar in a Weak Global Economy. Currency War Is Now a Dud as Windfall From Devaluations Vanishes. American cash is flooding into European stocks - Mar. 24, 2015. US companies sell record euro debt. Now is the time to fight currency manipulation. Fed, USD and currency wars. The Fed May Be Overreacting to the Dollar's Strength.

Gavyn Davies - the text is in the comment. Usd bull run. Currency wars threaten Lehman-style crisis. The Euro-Dollar Riot! Will China Break the Currency Truce? This is why the euro is collapsing. Market Report: Currency chaos. UPDATE 1-Goldman slashes euro forecasts, sees new low $0.80 by end-2017. Goldman sees euro falling to just 80 US cents - fastFT: Market-moving news and views, 24 hours a day. Euro Continues to Creep Higher Against Dollar. John Kicklighter sur Twitter : "Removing 'patience' can move forward the market's (Fed Funds futuers) pricing of the first move from Oct to June: AL sur Twitter : "EURUSD FOMC reaction. It didn't take long to go back to initial levels:...

Fed’s Covert Foray Into FX Policy Risks Wider Currency War - MoneyBeat. Dollar Flash Crashes: Currency Market Pulverized As Dollar Implodes After Close. EUR/USD to 0.95 in 12 months – Goldman Sachs. US Dollar Bounce May Yield to Renewed Selling on PPI, UofM Data. Corrective recovery underway for EURUSD. UPDATE 1-Goldman slashes euro forecasts, sees new low $0.80 by end-2017. How the U.S. Dollar Made a Spectacular Turnaround That Took Everyone by Surprise - Bloomberg Business. US Dollar Bounce May Yield to Renewed Selling on PPI, UofM Data. USD: Watch For Signs Of Valuation Constraint - BNPP. EUR/USD Technical Analysis: Floor Set Below 1.05 Level? Trading US NFP: What To Buy & What To Sell In 5 Scenarios? - Citi. Developed Macro: After ECB & Ahead Of A Likely Ugly NFP.

EUR/USD About To Close Below Key Breakdown Point; Stay Short For 1.3165 - Commerzbank. EUR/USD Lost Momentum; Stay Short Targeting 1.33 - Credit Agricole. Morgan Stanley Sells EUR/USD From 1.38, Buys USD/JPY From 97.25. EUR/USD: Who Got It Right This Time? Trade Idea: EUR/USD - Buy at 1.3700. Tactically Short USD Vs EUR But Still Bullish USD M/T - Credit Agricole. EUR/USD: 'QE Forever' - Commerzbank. Why We Stay Long EUR/USD Targeting 1.3830 Coming Wks - Credit Agricole. Stay Bullish EUR/USD Against 1.3452/12; USD/JPY Chop Continues - BofA Merrill. EUR/USD 13-Day MA Continues To Hold; Stay Long & Add On Dips - Credit Suisse. Trade Idea Wrap-up: EUR/USD - Sell at 1.3625. Positioning & Valuation To Restrain Further EUR/USD Upside; Stay Short - BNP Paribas.

Morgan Stanley US Default Last Resort. Flash: Will the EUR/USD sustain the upside? – Commerzbank and Danske Bank. Trade Idea Update: EUR/USD - Hold long entered at 1.3520. EUR/USD to rise to target level 1.3614 after breaking hourly Triangle.