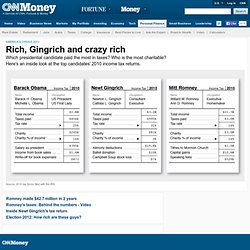

Romney, Gingrich, and Obama release their 2010 income tax returns. Rich, Gingrich and crazy rich.

Jobless Rate Dips to Lowest Level in More Than 2 Years. Stock Market News — 6 Small-Cap Stocks That May Rise Up to 82 Percent — CNBC.com Stock Blog. S&P Capital IQ's equity analysts say the companies are trading at about 16 times their trailing 12-month earnings and significantly below 12-month share-price targets.

The S&P 500 Index is down 0.85 percent this year, while the industrials sector has slumped 3.8 percent. Here is a synopsis of the six firms that S&P favors: 1. Kelly Services, an employment-services firm with a market value of $530 million, gets high marks from S&P, as it says the company "has the most upside potential currently" of this group of stocks. S&P Capital IQ's target price is a potential upside of 82 percent from its current $14.28. Risks to S&P Capital IQ's recommendation, which are pretty widespread, are "a resumed global economic downturn, stagnation in labor markets, the company's inherently cyclical business. " Effective tax rates. Econ 101: September 30, 2011. Federal Reserve perks up on the economy - Nov. 2. NEW YORK (CNNMoney) -- The Federal Reserve issued a slightly better outlook on the economy Wednesday, but cut its economic growth forecast for the year overall.

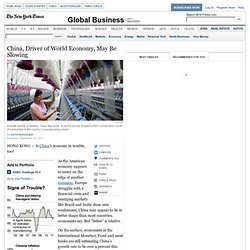

Following a two-day policy meeting, the central bank voted 9-to-1 to make no changes to the Fed's ongoing stimulus program, and maintain its pledge to keep interest rates at record lows "at least through mid-2013. " The Fed has held rates near zero since December 2008. Chinese Economy Shows Signs Its Growth Is Slowing. Reuters A textile worker in Huaibei, China, this week.

A recent survey showed a third consecutive month of contraction in the country's manufacturing sector. As the American economy appears to teeter on the edge of another , Europe struggles with a financial crisis and emerging markets like Brazil and India show new weaknesses, China may appear to be in better shape than most countries, economists say. But “better” is relative. On the surface, economists at the International Monetary Fund and most banks are still estimating China’s growth rate to be over 9 percent this year.

And yet, the country’s huge manufacturing sector is starting to slow and orders are weakening, especially for exports. Because China’s mighty growth engine has been one of the few drivers of the global economy since the financial crisis of 2008, signs of deceleration could add to worries about the global outlook. Chinese exporters are particularly worried. Follow the money: Bailout tracker - CNNMoney.com. CNNMoney.com is tracking developments in the economic rescue as they happen.

Click the links to the right or scroll down to find out how much the government is putting on the line. Troubled ASSET RELIEF PROGRAM. Bank reform: To rip asunder. US and Europe risk double-dip recession, warns IMF. The International Monetary Fund warned on Tuesday that the United States and the eurozone risk being plunged back into recession unless policymakers tackle the problems facing the world's two biggest economic forces.

In its half-yearly health check, the Washington-based fund said the global economy was "in a dangerous place" and that its forecast of a slow, bumpy recovery would be jeopardised by a deepening of Europe's sovereign debt crisis or over-hasty attempts to rein in America's budget deficit. "Global activity has weakened and become more uneven, confidence has fallen sharply recently, and downside risks are growing," the IMF said as it cut its global growth forecast for both 2011 and 2012. The IMF also cut its growth forecasts for the UK economy and advised George Osborne to ease the pace of deficit reduction in the event of any further downturn in activity. "The eurozone is a major source of worry. This is a call to arms," he said. "Lower growth makes fiscal consolidation harder. Why investors still worry about Europe - Video - Markets.

Will Europe trigger another global economic crisis? Please support our site by enabling javascript to view ads.

The euro zone debt crisis took another dramatic turn Tuesday as thousands of Italians hit the streets in a general strike, protesting a new round of austerity measures. Europe's woes continue to rile global investors. The Swiss National Bank surprised the markets by setting an exchange rate cap on the soaring franc, which investors have been flocking to as a safe-haven currency. European stock markets, meanwhile, hit their lowest point in two years Tuesday. While Europeans take their August vacations and leaders prevaricate, investors are growing increasingly concerned that the continent’s common currency could collapse, and that one or more countries could default on their debt, leading to another global economic crisis.

More from GlobalPost: German court rejects challenge to eurozone rescue deals For insights on the current state of the crisis, GlobalPost turned to economist Yannis M. He’s right. Compare that to the U.S. Yes.